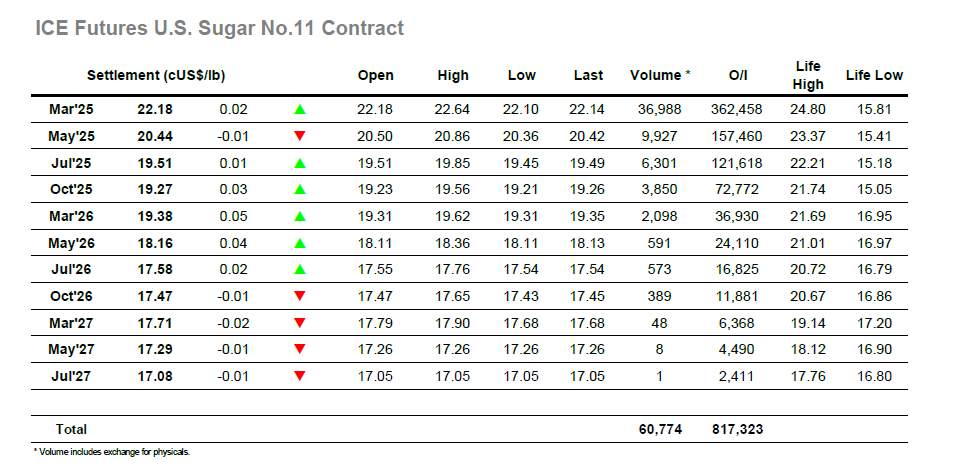

March’25 started the day positively and moved further away from 22.00 and yesterday’s lows, quickly reaching the upper 22.40’s where progress stalled. A calm morning then ensued with the next movement only arising just after noon with more buying from smaller traders/specs arriving to try and kick start another rally and draw in US traders. The price spiked to 22.64 and continued a short way beneath this mark for a period, however the usual pattern of trading means that there is little interest from the larger funds in joining these moves and so the inevitable retreat on liquidation followed. The market tried to dig in through the afternoon and remained broadly positive, however there was a sting in the tail from pre-weekend liquidation which erased most of the gains during the later stages. Spreads were solid as March/May’25 ended the week at 1.74 points following a day spent entirely in the 1.70’s, while March’25 flat price settled a mere 2 points higher at 22.18 after the late pullback. This concludes a low volume week with this month’s trading range still showing no sign of breaking, many will be optimistically hoping the return of traders to desks after the London sugar week can change this.

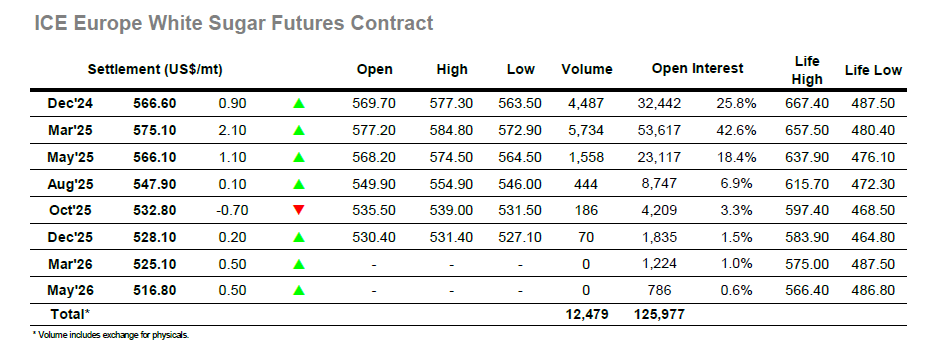

The market stormed out of the traps and pushed higher this morning, with specs sufficiently re-engaged to send Dec’24 up by $10 within the first half an hour. Volume was patchy as a consolidation pattern developed across the rest of the morning with many traders still holding orders to the respective ends of the range, however the sentiment remained positive with gains being registered for white premium values across the 2025 positions. Early afternoon saw the specs make another push up and recorded highs at $577.30 through their efforts, but there was no continuation interest and so frustration drove a liquidation-based retreat which struggled to find much buying and led to some very patchy gaps on the intra-day chart. Returning towards overnight levels there was a little more buying showing up which enabled prices to hold in the mid $560’s for most of the afternoon, the market increasingly stagnating as fewer traders participated ahead of the weekend. The last hour saw more liquidation and sent the market back into the red, hitting Dec’24 down to $563.50 as Dec’24/March’25 weakened off to -$9.50. White premiums were back off the morning highs with March/March’25 at $86.10 and May/May’25 at $115.50 as we end the week while Dec’24 settlement at $566.60 marks another day of unchanged parameters.