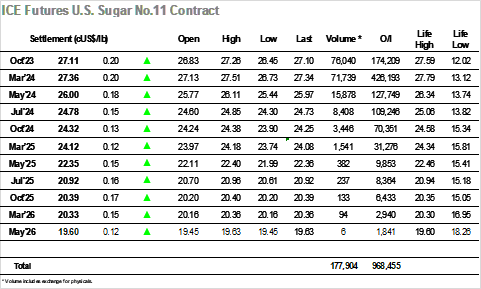

Having fallen back sharply from the 27.79 contract high mark on Friday afternoon the was a continuation of the spec liquidation to start the week with March’23 being pushed down to 26.73 by the end of the morning. Fridays COT report showed only modest growth in the net speculative long position which now stands at 192,265 lots, and while the larger funds are happy to sit on positions the smaller traders continue to flit in and out of the market, in turn triggering the algo systems. The fickle nature of these traders led the market to recover sharply during the early afternoon, positions being re-established as March’23 reached 27.36 and then 27.51 with producer sellers continuing to be difficult to find. While this brought the contract highs back into view the market was lacking the substance required to mount a challenge, and instead the price action calmed to consolidate the upper part of the range. This pattern was maintained through the rest of the session and eventually led to a March’24 settlement value at 27.36, keeping the strong technical picture intact. Oct’23/March’24 ended the day unchanged at -0.25 following another solid day of pre-expiration position rolling.

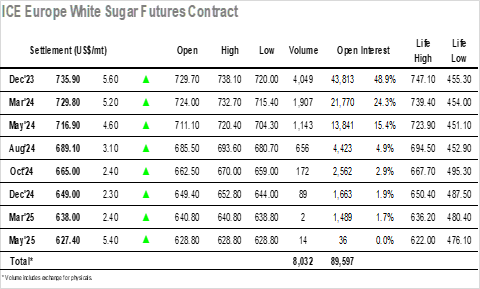

Dec’23 began its tenure at the top of the board with a morning decline, with the pullback from contract highs that commenced on Friday continuing all the way to $720.00 before the selling / position liquidation eased. The corrective action came to an abrupt halt at this point with spec buyers stepping back in to defend the recent gains and this led the market to regain the lost ground from the morning at a far more rapid pace, with the market soon heading to anew daily high at $733.30. With spreads trading quietly in the post expiry environment the traded volume was low and following a pause this allowed for the market to push higher again on only limited size, Dec’23 reaching a high at $738.10. White premiums meanwhile were losing some ground as the pace of spec buying for No.,11 outstripped our own gains, and March/March’24 printed briefly to $125.00 before regaining some ground later in the afternoon. The final part of the day proved to be quiet, edging toward a close where the market was dressed back towards the highs to leave Dec’23 settling positively at $735.90.