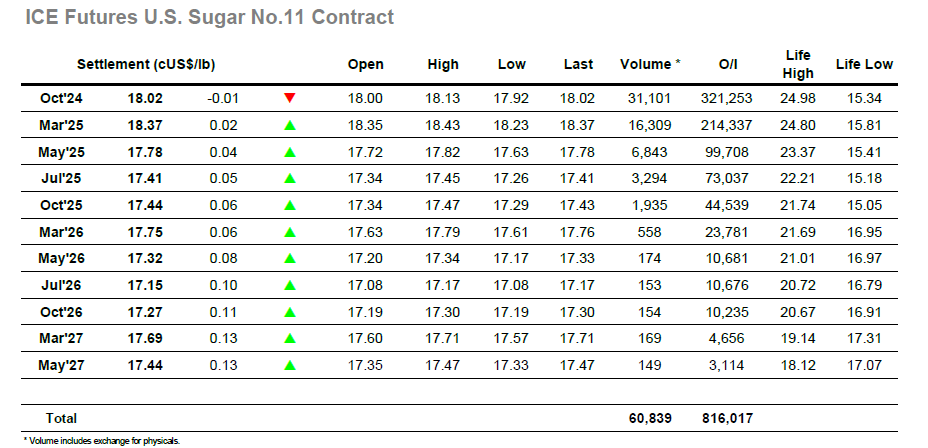

The market opened lower to start the week, reaching the day’s low of 17.92c/lb within the first 15 minutes of trading. From here the V24 No.11 futures quickly recovered 20 points before hitting resistance around 18.10c/lb and setting the tone for the rest of the session. Throughout the majority of the rest of the day prices moved in a relatively orderly fashion in a tight range, bouncing between 17.95c on the lower end, and 18.10c on the upper with little else of interest to report on. Settlement was reached at 18.02 c/lb with daily volume amongst the lowest in the previous few months after only 31k lots traded on the front month.

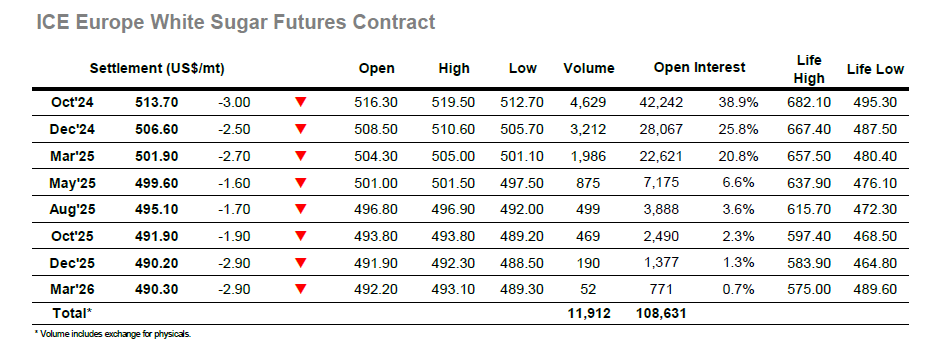

The white sugar market fared similarly to the raws as we head into the final month of trading on the No.5 V24 contract. Initial volatility saw prices move down to the day’s low of 514.6USD/mt to the day’s high of 519.5USD within the first hour of trading before settling into a tight sideways range on very slim volume for the rest of the session. Trading finished for the day toward the bottom end of this range with settlement at 513.7 USD/mt. With this the VV24 white premium remains largely unchanged from last week at around 118USD/mt.