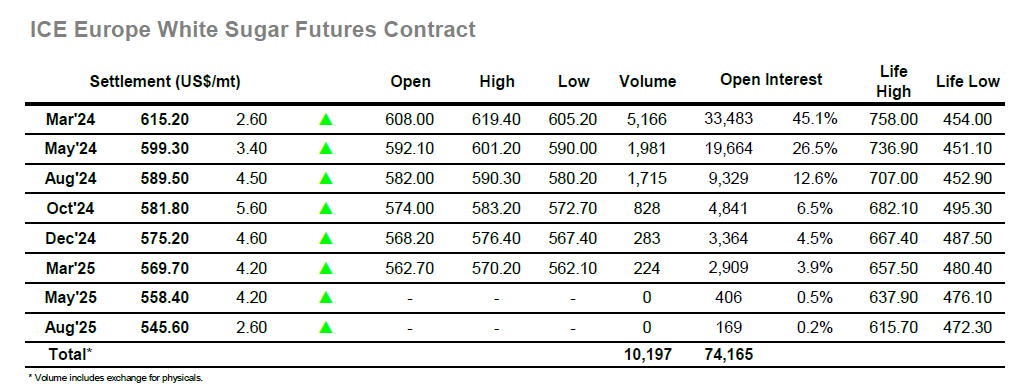

It was a very familiar pattern of trading that kicked things off today as initial gains against hedge lifting erased in an instant with traders once again looking to press the short side in search of sell stops and fresh momentum. More than 6,000 lots traded across the first 10 minutes as March’24 plunged through the light consumer scales to trade at 20.85, its lowest level since late March, further increasing technical vulnerability. Short covering followed to bring the price back above 21.00 and the picture then settled down to see a tight range hold through the rest of the morning. With the Americas day getting underway there was a pickup in activity with the March’24 contract moving into positive ground at 21.43, and while this was not sustained it did change the sentiment from day traders with the market not showing any further signs of intra-day weakness. Following another period of rangebound trading the market found fresh impetus during the final couple of hours, still lacking the sizable buying required to mount a major recovery, but in the context of this morning’s lows it was a steady showing. The one oddity was the failure of the nearby spreads to match the recovery with March/May’24 struggling at the bottom of its range with trades wither side of 0.50 points. Position squaring did send March’24 back from its highs ahead of the call with settlement made at 21.43, while the spread remained weaker and closed at 0.52 points.

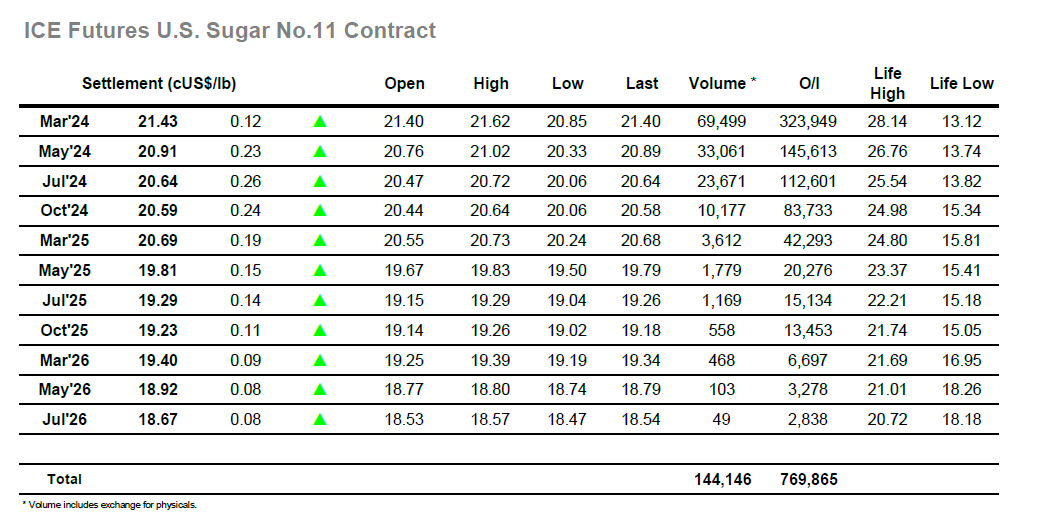

A small gap lower on the opening was quickly filled, however the weakness saw another burst of spec selling emerge with early selling extending the decline to $605.20. With most long holders having now liquidated positions the market stabilised as sustained downward movement now will be reliant on traders deciding to build a short, something which has not yet occurred despite the considerable decline. In the absence of this a period of sideways consolidation followed, from which the market was able to pushback into credit at $615.00 midway through the day. With the specs now proving reluctant to commit to the market from either side there was further consolidation to follow, and it was only during the later part of the afternoon that things became more interesting with smaller specs extending the daily range up to $619.40. While not a significant rally it does show some sign that traders may be feeling we are now near to a bottom, though with no other buyers wanting to join and push there was the inevitable sight of long liquidation / position squaring heading towards the end of the day. This left March’24 settling at $615.20, mildly positive but still with much work to do if we are to escape from these current levels.