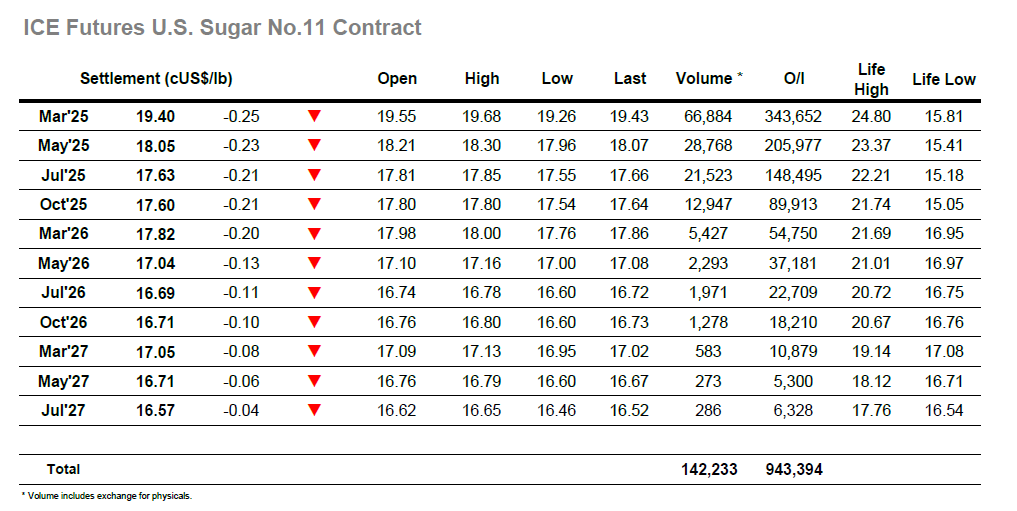

The wounds from recent sessions were immediately reopened as March’25 was pushed immediately through yesterday’s 19.55 low mark and trade down to 19.37 with less than 30 minutes of the day having elapsed. This was possibly a little more sudden than expected and so with no continuation of the pressure the usual pattern of small trader covering followed, combining with some light pricing interest to bring the value back to briefly touch at unchanged before fading into the range across the later morning. The gentle sideways pattern continued into the afternoon against light volume till the market experienced further pressure reaching new lows of 19.26, though it seemed that there is little interest in bringing the market too far away from the lows presently with the still weakening Brazilian Real (USDBRL at 6.29) ensuring that the ceiling of producer pricing ratchets lower. This was followed by a short rally upwards touching 19.6 but as closing approached it fell back to 19.43 unable to sustain the previous range we saw earlier in the afternoon.