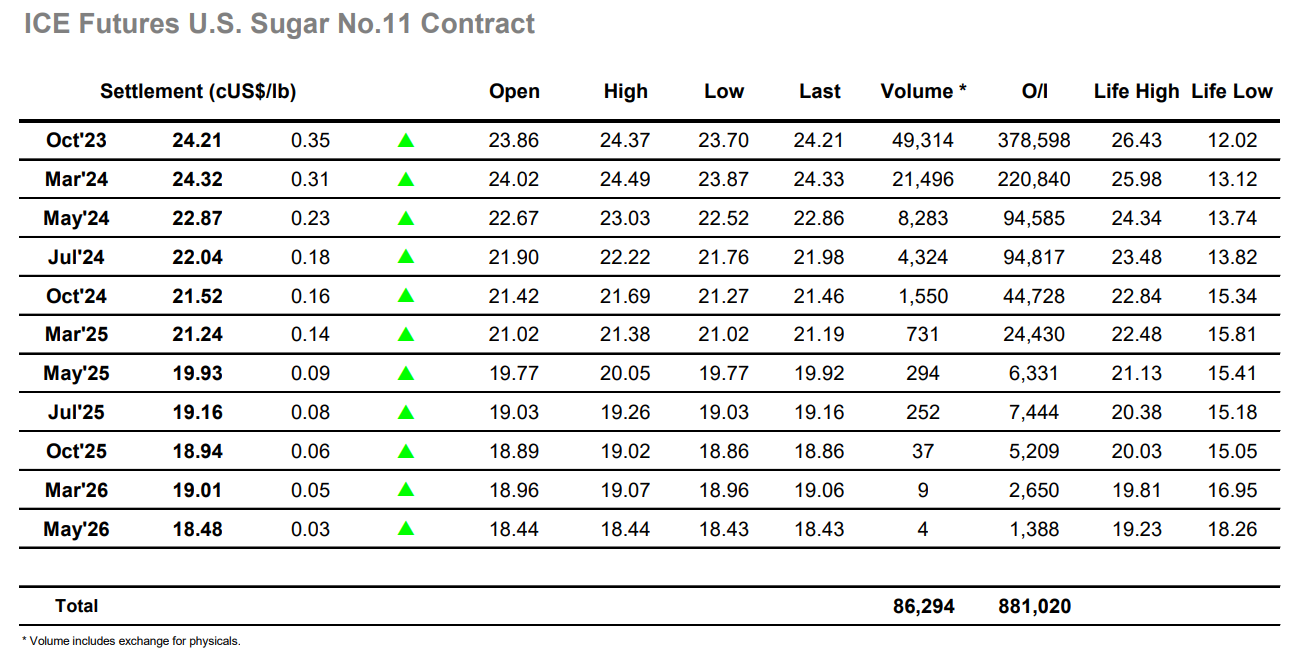

Off the back of yesterday’s quiet session, the market was again muted during early trading with an initial dip to 23.70 picked up before the market proceeded to sit quietly in the 23.80’s. The day had all the feeling of a summer malaise however the early afternoon brought the arrival of US participants and with specs looking to buy (possibly in reaction to gains made in the wheat/grains sector) the market once more began to track higher. There was little selling in place and so the path was clear to quickly bring prices up through the recent range at a pace, with selling only really becoming apparent in the 24.30’s as the market approached the recent 24.40 high. Unlike other recent efforts there was no immediate pullback against long liquidation, though following an extended period of consolidation there was a pop back down to 23.96 as some headed for the exit. Still the specs persisted and buoyed by the continuing macro strength were bidding the market back up heading towards the close. This led to positive settlement values with Oct’23 ending the day at 24.21, though there remains work to do if this is not to be another false dawn in the efforts to move higher.

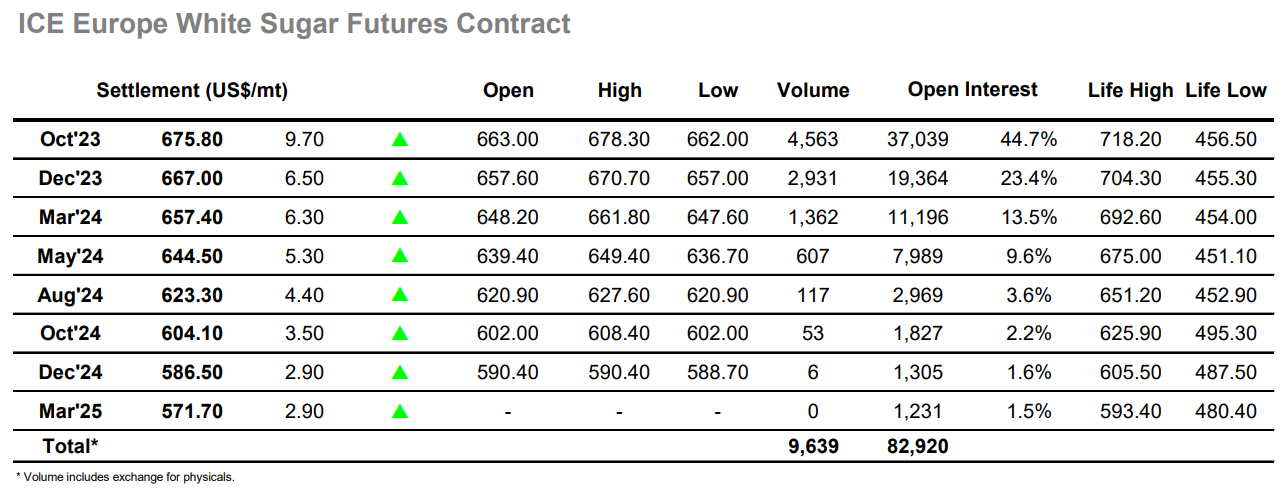

Early trading was reminiscent of that seen yesterday as Oct’23 traded down to $662.00 on the opening but found support to hold the mid/upper $660’s through most of the morning, though volume was again incredibly light. It has been tough to find anyone beyond the specs prepared to push the long side in recent days, and that picture remained true moving into the afternoon as the US based specs gave the market its latest push higher, finding little resistance in taking Oct’23 up through into the $670’s. This still placed the market some distance shy of the highs seen on Friday and Monday, and with some moderate selling emerging for the upper $670’s the market topped out at $677.40 before looking to consolidate the gains. Despite the flat price rally there was a far tighter range being seen for the white premiums with Oct/Oct’23 maintaining a band between $140 and $142.50 for most of the day, while for the spreads there was a strengthening of Oct/Dec’23 to $9.00, largely attributable to the flat price buying of the front month. The closing stages saw Oct/Oct’23 briefly push past $144 as the flat price was driven to a new high at $678.30 before some end of day position squaring sent the price back to settle at $675.80.