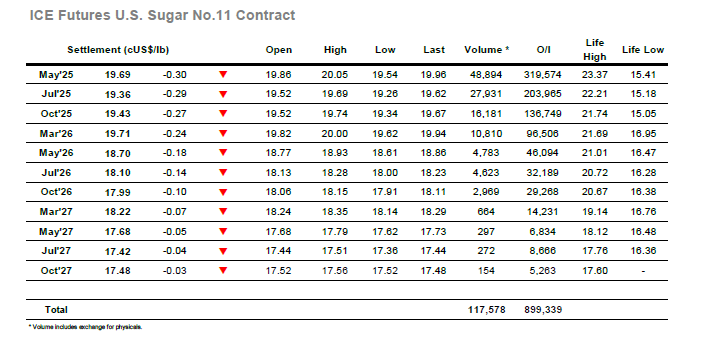

The day started slowly with May’25 settling down to sit quietly in the 19.90’s, still holding the same area just beneath the recent highs as traders look to build the market to explore further into the scale selling which rests above 20c. By mid-morning, the prices had edged up to 20.05, just 0.04 points short of yesterdays mark, however with only day traders driving the movement the market stalled and then slipped down to 19.83 against position liquidation. The early afternoon saw some spec interest from the US help the spot back up to 20.01, but again the movement halted against the overhead selling to raise more questions as to whether the rally has extended far enough. A short period of calm preceded a more aggressive round of long liquidation from the smaller traders that sent the price all the way back to 19.54, and while there was a small recovery to the 19.70 area that proved to be the extent of the movement as the remainder of the session saw another period of stagnation. The lower market levels had also brought down spread values with May/Jul’25 seeing lows at 0.28 points, though the value did recover back to the lower 0.30’s during the latter stages. May’25 settled at 19.69 to end the inactivity of the last three hours, setting the market back into the range once again.

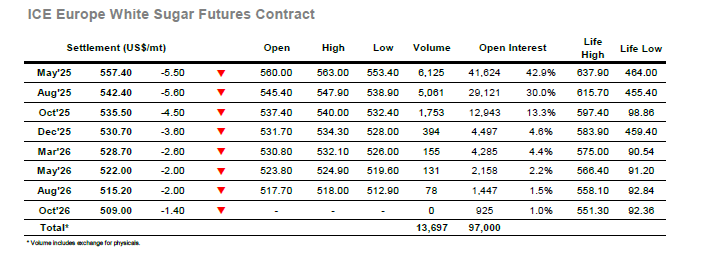

Having posted a disappointing performance yesterday the market continued to struggle as we resumed with May’25 tracking along in the lower $560’s and lacking any spark to move back upward. A brief print at $563.00 was the only time that the May’25 contract moved positively and with smaller traders loaded on the long side the failure to build caused some to close positions and send the price tumbling to $556.60 before the morning was through. This weakness was fuelling further losses for the white premium values as May/May’25 slipped towards $119.00, though volumes were light, and the overwhelming feeling was that the market was just fatigued having overextended on the recent rally. May’25 did work back above $560.00 during the early afternoon as longs looked to defend against the losses, however another round of selling was to follow and led to a larger fall and a daily low at $553.40. One area which did not struggle was the May/Aug’25 spread which dug in around the $15 mark following yesterday’s pullback, seeing steady volume throughout as rolling begins to emerge ahead of next month’s expiry. The last few hours saw prices sit within a tighter band and leave May’25 settling at $557.40 when the close finally arrived. May/May’25 was able to pick back up to $123.25 during this period, but overall, it was another unconvincing showing which leaves a good deal of work to be done if the upside is to resume in the coming days.