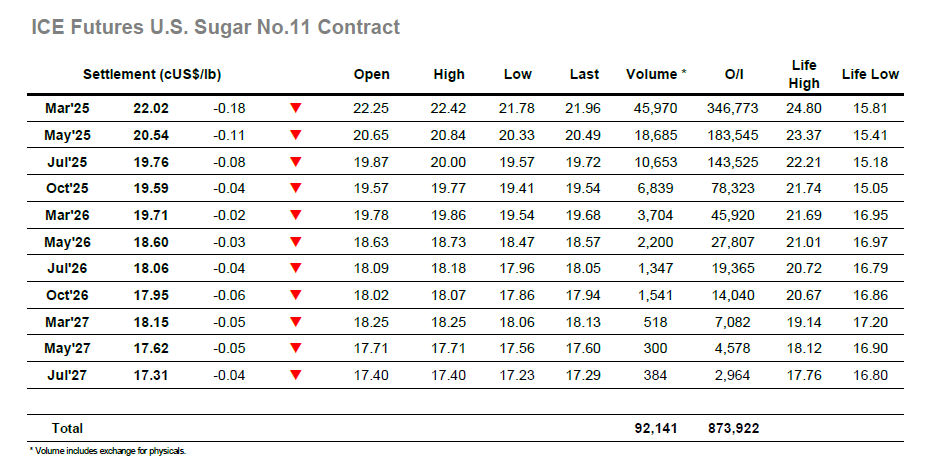

Buyers were again in the ascendancy as we resumed with higher opening prints providing the basis from which the market could continue to look higher. Progress was not so rapid as that made yesterday morning however the sentiment was strong enough to take March’25 to 22.42 midway through the morning before looking to hold. This was not achieved however and so as day trader liquidation kicked in the market was sent tumbling back below overnight levels where it looked to find support and rebuild ahead of the afternoon. There was an uptick back to 22.36 but it did not sustain once the day trader appetite for buying eased, and when another round of position squaring occurred March’25 found itself wobbling back to lows at 21.78. March/May’25 also saw selling across the afternoon and fell back into the low 1.40’s, not major weakness yet sufficient to dent confidence amongst the main participants. There was a move to try and bring the price back up above 22.00 during the later stages which minimised the losses to 22.02, leaving the market with a directionless appearance and likely to see continuing range activity for the near term.

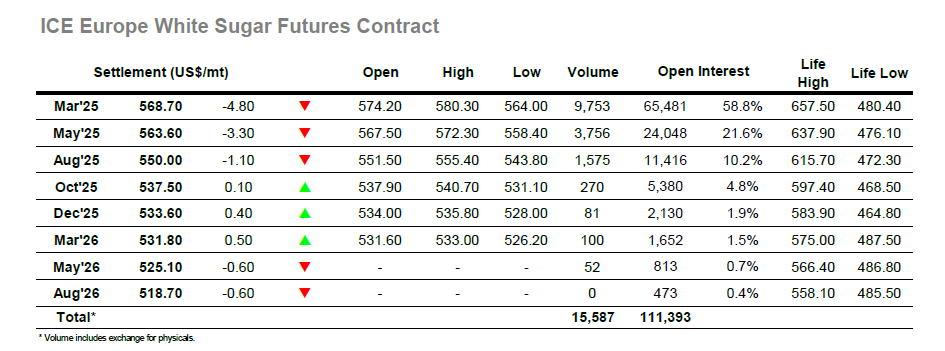

The market was little changed on the opening, but it was not long before the upward trend resumed, with moderate buying proving sufficient to take the market up towards $580.00. This mark was only seen briefly however and having stalled some long liquidation kicked in to undo much of the work and leave values back where they had started ahead of the more liquid afternoon period. Initially the market did try and pull back up as the US morning drew in a little more interest, but it did not sustain and having slipped to new daily lows some more concerted liquidation took place and sent March’24 back into the $560’s. There was no meltdown to follow this and instead the picture settled down with the rest of the afternoon seeing low volume as the market drifted. The spot losses did impact upon the spreads with March/May’25 trading below $5 later in the afternoon, while the spot white premium lost a couple of dollars and was holding near to $82.00. Prices did pull away from session lows during the later stages, resulting in a March’25 settlement level at $568.70, bringing the session to a close with prices sat firmly to the centre of a wide trading band.