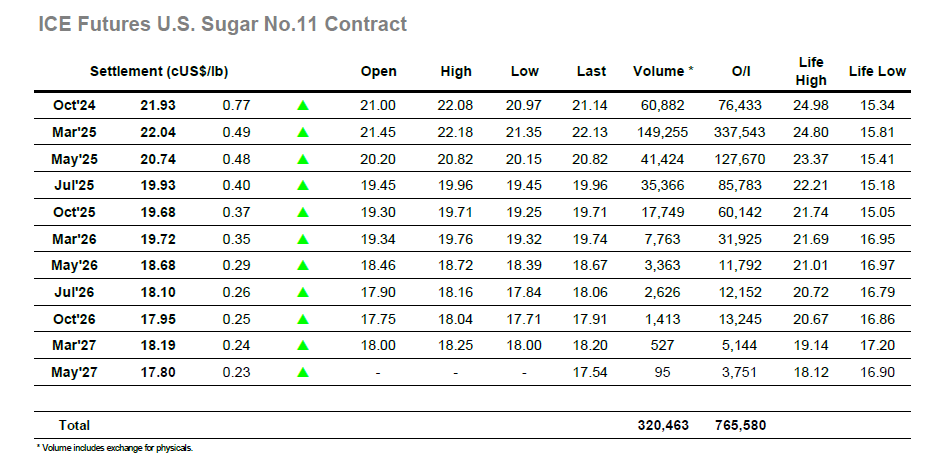

Early trading saw a pause in the relentless progress made across the past two days with specs standing back and consumer interest very limited but having gathered the initial dip the speculative entities stated to reappear. Initially they pushed the market without looking to throw any excessive volume at the situation, but this alone was yielding results for the longs as March’24 traded above yesterday’s highs to reach 21.84. The progress was maintained through the rest of the morning but despite sitting positively at noon the market saw a corrective dip which had prices trading negatively in the 21.40’s as the US day got underway. Any concern from the longs that this may mark the start of a reversal were dispelled with some stabilisation around unchanged levels, which in turn encouraged buying to restart in far greater size. The market worked back to the earlier highs at a steady pace before pushing through and accelerating ahead as additional interest poured in from all sectors. Solid scale selling from producers across the near and middle positions was being filled in at pace as the market accelerated ahead to 21.18, although a similarly sharp correction then followed against liquidation / profit taking which quickly erased 50 points of the gain. The bulls were not deterred by this and resumed buying once the storm was over and by late afternoon had the market again trading back above 22.00. March’25 spreads ere cementing recent gains and did not push ahead in the same fashion as yesterday, however at the top of the board some pre-expiry rolling was causing the Oct’24/March’25 to strengthen with a move up to -0.20 points representing its highest value this month. The usual mix of MOC activity did not prevent March’25 from another strong settlement, above the psychologically significant 22c mark at 22.04 and in position to try and maintain the push ahead of the weekend.

Lower opening prints were short-lived and with buying flowing in the market was showing well through the early part of the session with a rise to $565.50. These gains were comfortably consolidated through the morning with marginal new highs recorded, and while there remained an element of tracking against the spec driven No.11 the picture appeared more comfortable with lower white premium values drawing supportive buying to aid stability. There was a drop back into the high $550’s as we moved into the afternoon however the current market has plenty of strength and specs are in no mood to hand back the initiative and stop the current drive higher. Through to the middle of the afternoon there was heavier buying pushing in and extending the gains to $572.00, though many will have been frustrated that the move topped out before challenging the former $574.90 high mark. Day trader profit taking did then send values tumbling back into the range however the drop was re-gathered and the price recovered to the upper end of the range ahead of the close. As mentioned, there was some buying for the white premiums at last with March/March’25 moving back into the mid $80’s, while at the top of the board we saw the Dec’24/March’25 spread relatively flat on the day. There was no significant movement on the close, leaving Dec’24 to settle at $568.60 to end another positive session.