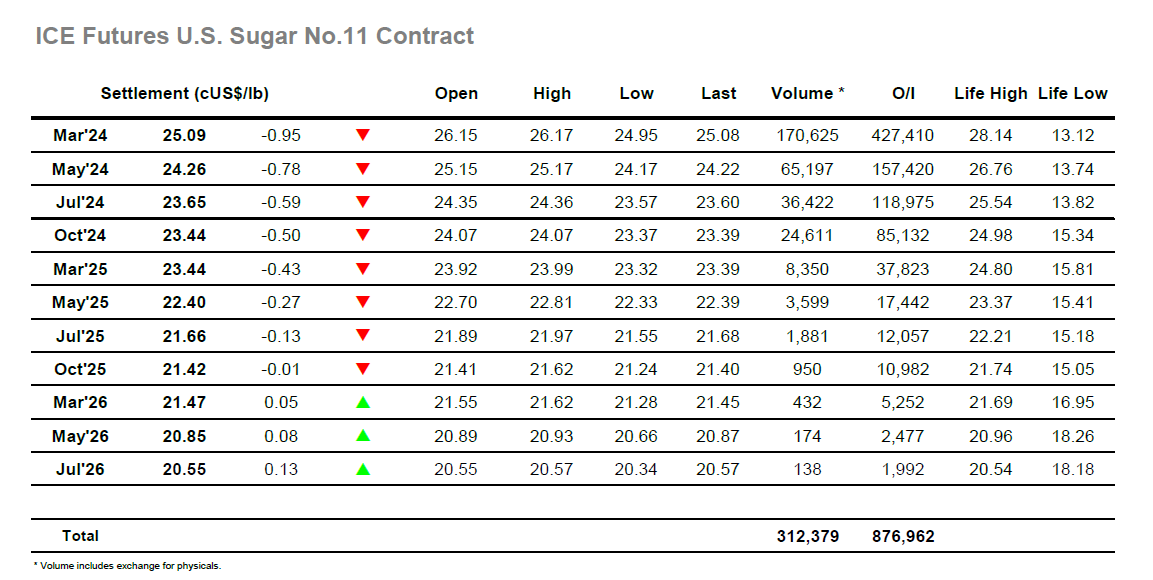

A significantly higher call was being generated this morning as buy orders arrived on the pre-opening versus physical activity, but such was the impact of yesterday’s fall that strong selling was quickly in place to meet them. March’24 had initially printed at 26.15 however it was swiftly trading back below 26c on the strength of this selling, and with the hedge lifting concluded there was again little buying aside from the GTC scales to stem the tide. This enabled the initial fall to extend down to 25.57 before the selling eased and some respite arrived, though what masqueraded as a bounce simply involved the market levelling out around 25.70 where prices remained for the rest of the morning. Spreads were heavily impacted by the sizable March’24 selling with March/May’24 losing more than 0.20 points from overnight, a worrying sign for those hoping that values would be able to dig in. The arrival of US based specs and funds only served to add to the weight of liquidation as the afternoon got underway, the momentum again building and sending prices beneath October’s 25.28 low and incredibly to print at 24c handle with lows at 24.95. This represented a 1.09-point loss for the day and with so many specs and algo’s playing short alongside the liquidation the was finally something which could be acknowledged as a bounce with their profit taking causing some chasing from consumers and a sharp recovery to 25.64. The shelf life of the bounce was limited however while the funds remain in the current mode and so as buying dissipated, so prices fell back down to the lower end of the range to sit at 25.20 moving through the final hour. The closing stages saw a push back towards the lows and eventual March’24 settlement at 25.09, though march/May’24 made a late comeback to end the day 0.10 points off its lows at 0.83 points. Having fallen almost 2.00 points in 2 sessions the market will likely attract more physical hedging on Monday, though with the impact on the COT still a week away there will be limited information to gauge just when the funds have liquidated enough.

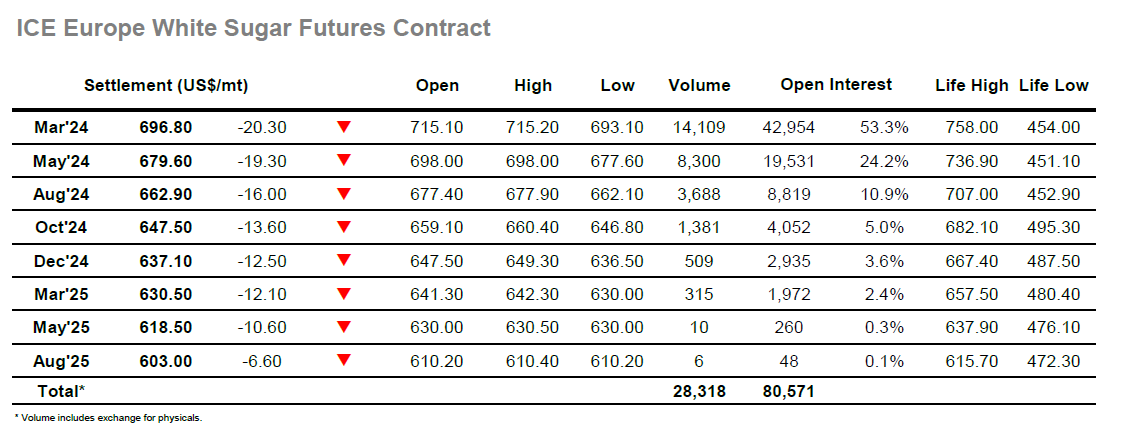

Whites were indicated lower this morning on the back of No.11 and despite a better than anticipated start at $715.10 the March’24 contract was falling lower once more with trades at $709.00 within the next 30 minutes. The selling then eased to allow some relief, however there was no sign that anyone was prepared to push back against the current tide and so prices simply entered a consolidation pattern in front of the early lows, supported by the ongoing scale buy orders. The picture showed no change until we reached early afternoon, and when it did the continuation lower will have surprised few given that funds/specs rarely change approach when the market has moved so sharply. With increasingly little support being found to stand in the way, March’24 slipped consistently to a low at $693.10 before finally finding some respite in the form of short covering from smaller specs and day traders, though such is the damage inflicted recently that it proved to be an anomaly with the trend resuming once the cover had been taken. Moving through the final two hours March’24 steadily fell back towards the lows with March’24 continuing to appear weak with a close beneath $700 at $696.80.