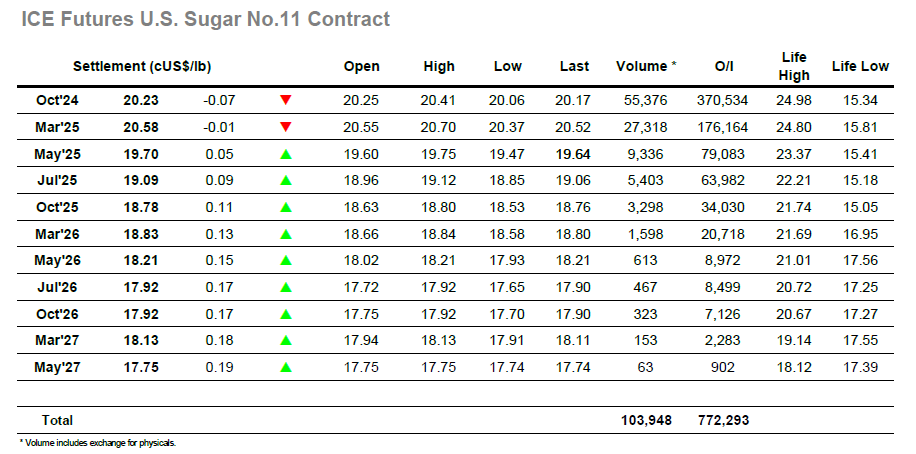

Oct’24 chopped either side of unchanged during early trading but as things settled down it was the lower side of the market which became the focus. A period was spent holding either side of 20.20 but pressure started to build by late morning with the market ticking down to 20.06. Fridays COT had shown a sizable covering of the net speculative short with almost 25,000 lots covered back to now stand at -29,162 lots, and the likelihood is that the movement over the subsequent 3 sessions will have seen a good proportion of this number covered also. Prices tracked ahead of the lows into the afternoon, but having averted the threat of falling back below 20c the market found a shot in the arm from day trader short covering and light algo interest to ping back up to 20.39 and trade just shy of the opening highs. The move was lacking substance however and so with the covering complete we slumped back into the range where the remainder of a slow session played out. Spreads provided some moderate volume as Oct’24/March’25 meandered to a close at -0.35 points, while the flat price closed 0.07 points lower at 20.23 to conclude an inside chart day. [

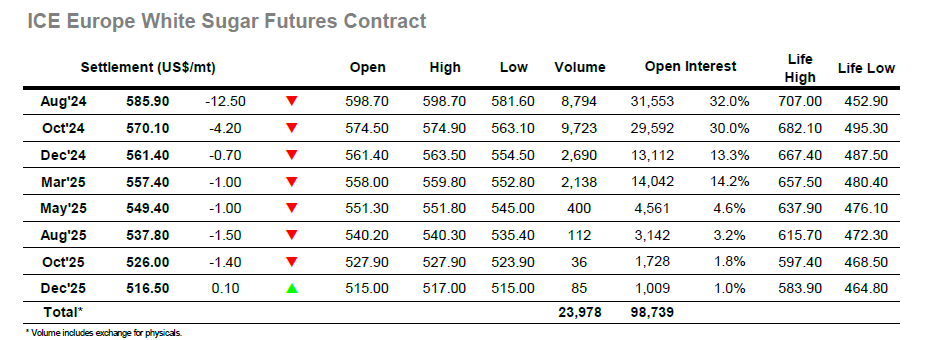

• It was a wild ride for Aug’24 this morning as opening highs at $598.70 were quickly erased with the early decline extending all the way back to $582.30. This kind of volatility has been familiar to Aug’24 over recent sessions, and despite there remaining over two weeks until expiry the impact of rolling and hedge liquidation has been significant. These initial losses saw Aug/Oct’24 drop by $5 to $19.10, though with pressure being seen down the board resulting in lower arbitrage values, it could have otherwise been worse. The market tracked along at the bottom of the range for several hours, making further lows at $581.60 for Aug’24 and $563.10 for Oct’24 before looking to pull back up during the afternoon. Oct’24 was more successful in this endeavour as it starts to attract more of the day trader volumes, pulling the Oct/Oct’24 arb back above $126.00 at one stage. Aug’24 meanwhile ticked back into the lower $590’s before falling back again late in the day with Aug/Oct’24 pressed down to a low at $14.80 in the process. Aug’24 settled at $585.90 and Oct’24 at $570.10, both uninspiring but having done no damage to the wider structure.