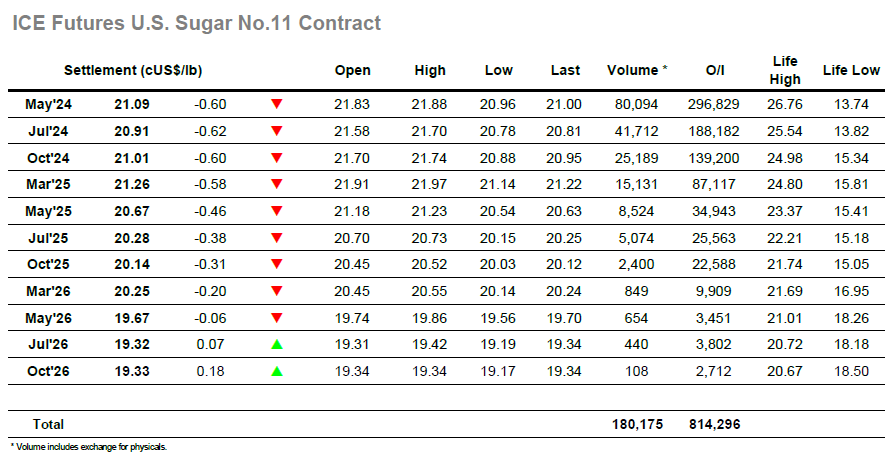

There was some overnight buying interest, and this served to push prices upward during the early part of the session with May’24 reaching 21.88 and remaining comfortable above 21.70 through most of the morning as traders attempted to provide some stability following yesterday’s correction. These efforts appeared in vain late in the morning as a sharp drop to 21.46 triggered some long liquidation, and suddenly the picture had changed, and an air of technical weakness hung over the market once more. Across the afternoon the outright prompts came under significant pressure from specs and algo’s looking to play from the short side, a rare situation in recent times, and despite the presence of scale buying with consumers happy to price at the best levels seen in almost two months the May’24 contract fell back. The decline extended all the way to 20.96, a massive 1.77 points beneath yesterdays highs, and though some profit taking then kicked in there was not any significant rally with the bounce topping out 21.29. Further struggle ensued during the final hour with prices returning to sit around 21c on the close, settling at 21.09 to head into the weekend negatively. Tonight’s COT report will prove interesting as it will provide an indication as to whether the specs have now started to turn to a net short position, providing plenty of discussion points for those heading to next week’s Dubai conference. As expected, the March’24 expiry saw 25,751 lots (1,308,215t) tendered.

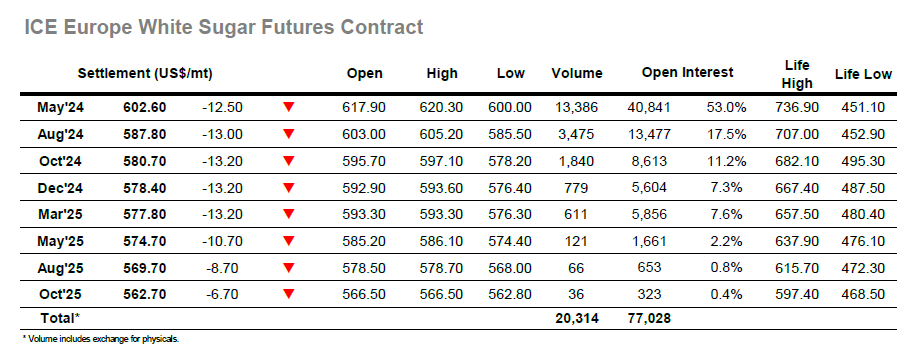

The sharp retreat yesterday drew out some overnight physical interest and the resultant hedge lifting had the market trading a few dollars higher as we resumed. These gains were maintained through the first couple of hours though as the buying eased so the market started to appear somewhat vulnerable once more with new daily lows being recorded before the morning was through. Around noon there was an acceleration in the decline which saw May’24 trading beneath $610 and having broken down to new recent lows the technical picture took over and encouraged fresh selling into the environment. Over the following hours there were a series of new lows recorded despite various resting consumer orders / scales being filled in, with the market only attempting to dig in and hold as the price neared $600.00. The weakness was not exclusive with No.11 also falling heavily, and white premium values held up relatively well with the afternoon seeing May/May’24 trading above $138 and Aug/Jul’24 at $127.00. Spreads were also proving quite resilient with May/Aug’24 holding around $14 late in the session, though it had seen an earlier intra-day low at $12.40 as the market fell. Despite some pre-weekend short covering there was a return to the lows ahead of the close, and with May’24 settlement made at $602.60 the technical picture looks weak heading into next week.