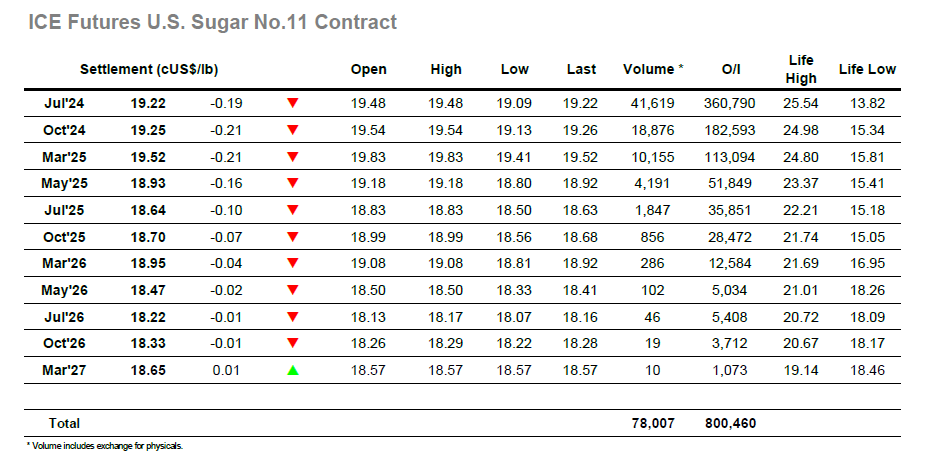

Jul’24 began its tenure at the top of the board by slipping back to 19.28, and though the price then rebounded to 19.48 there was not much enthusiasm being seen from buyers and so the moves into credit proved to be fleeting. With many parts of the world enjoying public holidays today there was a marked drop in participation, and maybe this led to a falloff in consumer activity / support as the price softened to new lows later in the morning. The tone was now set, and with Mondays rally long forgotten the market once again set about chipping away at support, though on such low volumes the general trend had more of a sideways bias. GTC scales from the teens provided this support and though the market slipped during the afternoon to 19.10 it was on minimal volume and there was no threat to the recent lows. Prices stabilised through the later part of the day, leading a slow session to conclude with Jul’24 settling at 19.22, leaving recent parameters unchanged. As was widely expected, the May’24 expiry saw 32,914 lots (1,672,114t) tendered with details found in the exchange notice below.

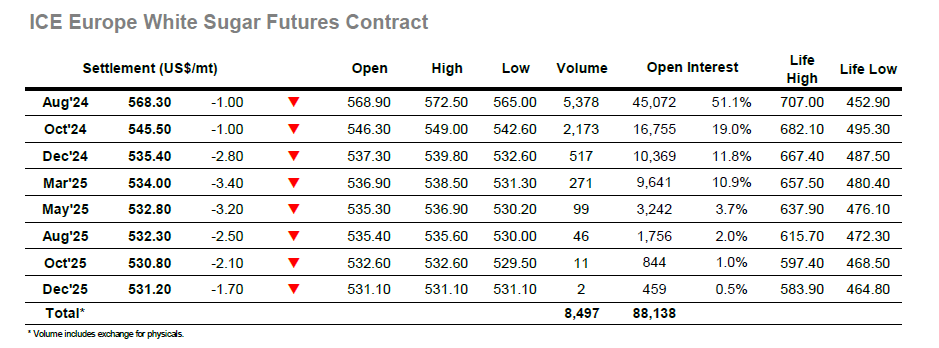

There was some light buying around this morning which quickly too Aug’24 back into the lower $570’s, however it lacked depth and so the market simply drifted along with no sign that traders were ready to push more aggressively at this stage. That lack of momentum drew some day trader selling and by late morning Aug’24 had dropped back to a small deficit to leave the market still firmly entrenched within the current broad parameters. There was a strengthening for the Aug/Jul’24 white premium which pushed back up above $143.00 during the morning, with traders recently showing better support for white’s values following the wobble that the arb values experienced post May’24 expiry. Volume remained thin through the afternoon and No.11 weakness pulled the whites back, though the Aug’24 low at $565.00 was only just beneath yesterdays mark. This support was aided by Aug/Oct’24 buying which drew the spread back up to $23.00 following an earlier dip to $19.90, its moderate volume still standing out with very little trading across the rest of the spread board. The final couple of hours proved to be calm with the market tracking back up from the lows to close at $568.30 and end another rangebound session.