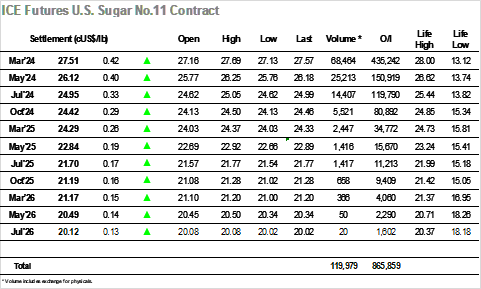

Today No.11 opened at 27.16, 7 points above yesterday’s settlement. Initial trading hour was quiet with some upward bias. It was around 10 am when volumes started to increase, and sugar gained momentum. Going to trade around 27.40. The next hour printed a sideways movement and by 12pm, another push was seen. At 1h30pm, No.11 was trading around 27.60. A sudden correction followed around 2 pm, when market went back to 27.40s. Bullish sentiment was still highly present, and market went up to trade at daily high of 27.69. Another correction followed and market retreated to 27.30s zone, Another strong push was seen towards closing, with No.11 ending the trading session negotiated at 27.57. Settlement price was 27.51, a +42 points movement from previous settlement. Volume traded was 68k lots and H4K4 spread closed at 1.3 (+2 points up). Today whites market opened at $733.8, up $0.8 from yesterday’s settlement. Strong bullish move was seen during the day with market touching $745 and strayed trading at those levels until 12pm. Daily high was registered in the subsequent moments, when market traded at $757.6 around 1h30pm. A correction followed throughout the session and market went down to trade around $746 in the half hour preceding closing. A strong push was then seen towards settlement and Z3 closed at $752.1. Settlement price was $749.4, up $16.4. Volume traded was 11.5k lots, considerably higher than previous days.

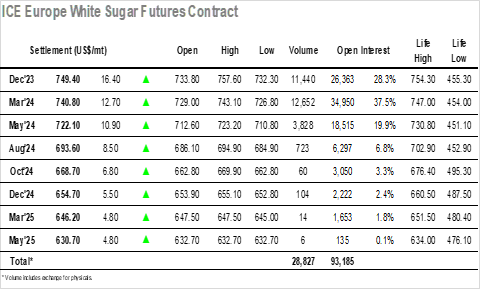

Today whites market opened at $733.8, up $0.8 from yesterday’s settlement. Strong bullish move was seen during the day with market touching $745 and strayed trading at those levels until 12pm. Daily high was registered in the subsequent moments, when market traded at $757.6 around 1h30pm. A correction followed throughout the session and market went down to trade around $746 in the half hour preceding closing. A strong push was then seen towards settlement and Z3 closed at $752.1. Settlement price was $749.4, up $16.4. Volume traded was 11.5k lots, considerably higher than previous days.

Daily Market Price Updates and Commentary 1st November 2023

Become a Thought Leader on our App

Are you an industry expert in:

• Soybeans

• Grains

• Dairy

• Fruit

• Freight

• Orange Juice

• Nuts and Seeds

• Fertilisers

• Carbon

We’re looking for leading voices who want to contribute their expertise to a global audience.

Find out how a partnership with us works below.

Related content

Daily Market Price Updates and Commentary 14th April 2025

Raw Sugar Update The week commenced with Jul’25 still sitting at...

Sugar Futures and Market Data: 14th April 2025

Insight Focus The raw sugar futures traded lower last week. Both produ...

Dry Weather Aids EU Beet Plantings

Insight Focus European beet plantings are happening rapidly. They’ve...

Daily Market Price Updates and Commentary 11th April 2025

Raw Sugar Update It was with some relief that the market posted a calm...

Daily Market Price Updates and Commentary 10th April 2025

Raw Sugar Update After yesterdays close the news of the latest Tariff ...

CS Brazil: Sugar or Ethanol? 9th April 2025

This report is updated weekly, for daily information refer to our Busi...

Daily Market Price Updates and Commentary 9th April 2025

Raw Sugar Update Following yesterday’s weak technical showing the ...

US Sugar Market Finds Some Support in Tariffs

This update is from Sosland Publishing’s Sweetener Report. For more ...

Want to learn more about Sugar

The Raw Sugar Futures July-October Spread

Welcome to the sixth instalment of Czapp’s course on futures market ...

The Raw Sugar Futures May-July Spread

Welcome to the fifth instalment of Czapp’s course on futures mar...

The Raw Sugar Futures March-May Spread

Welcome to the fourth instalment of Czapp’s course on futures market...

The Raw Sugar Futures October-March Spread

Welcome to the third instalment of Czapp’s course on futures market ...

Biomass: The Future of Renewable Energy

What is Biomass? Biomass is a fuel derived from organic material such ...

What Factors Influence Futures Market Spreads?

Welcome to the second instalment of Czapp’s course on futures ma...

Identifying Relationships in Commodities With Machine Learning

Insight Focus We have used machine learning to research commodity mark...

What is the Carbon Border Adjustment Mechanism?

Insight Focus Importers of carbon-intensive materials to the EU will p...