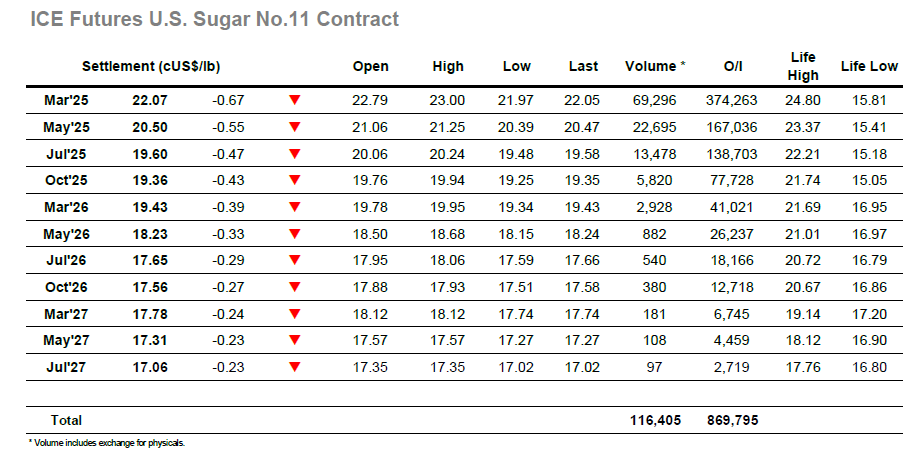

The market initially picked up where it left of on Thursday, opening positively and quickly trading above yesterday’s high. A surge of buying an hour into trading tried and failed to push the price back above 23c/lb, however this was quickly found to be short lived instead consolidating around 22.9c/lb over the mid-morning. This was the last of the positive story for the day, with a burst of selling shortly thereafter pushing prices into a downtrend. Aside from finding some brief support around 22.83c/lb, and then again around 22.66c/lb the rest of the session was characterised by consistent weakness, exacerbated with the US coming online into the afternoon. Over the next few hours prices tumbled all the back down to 22c/lb, giving up all gains made the previous day. The final hour saw slight retracement finally closing the week at 22.07c/lb, down 72 points on the day. More broadly it looks like the last month’s downtrend still appears intact with the H5 contract now over 250 points off the peak of September’s rally.

Like over on the raws, the whites market opened positively today, quickly trading up almost 5USD/mt, then finding another 4USD/mt off upside an hour later to reach a high of 583.60USD/mt for day. Proceedings then turned to the downside from here for the rest of the day, trading sideways-to low throughout the rest of the morning. Into the afternoon and selling became more aggressive, only finding some temporary support around 566USD/mt, already almost 20USD/mt down on the high. From here selling again prevailed, pushing the Z4 No.5 futures back below 560USD/mt with a few hours to go, before finally weakening further still to close the week at 558USD/mt. With this the recent sideways trend, observed throughout October appears to be intact, though if this momentum can be carried over the weekend we could see prices slide further into next week too.