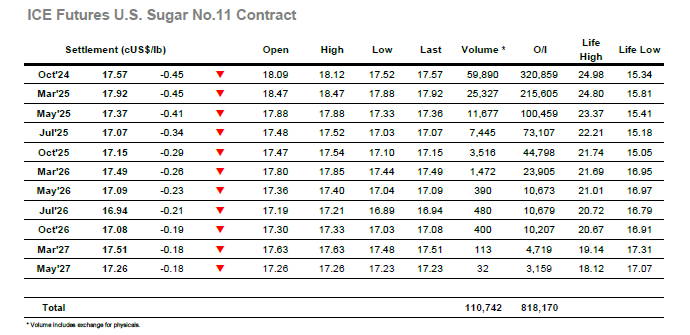

Following a very dry session on Monday, markets responded today with strong selling from the open seeing prices quickly tumble falling 40 points, before consolidating around 17.65c/lb to see out the morning trading. From here proceedings calmed a little with stronger buying upon the arrival of the Americas providing a more robust floor just below 17.60. Aside from a brief attempt to push the market back up over 17.70, trading through the rest of the session remained close to the day’s floor, closing the day at 17.57 c/lb. Volume-wise today represented the first day of over 50k traded on the front month for a number of weeks as buyers sought to capitalize on prices reaching a new low for the year. Should the market fail to recover back toward 18c over the next few sessions it could suggest the end of the long held sideways range, allowing prices to drift lower.

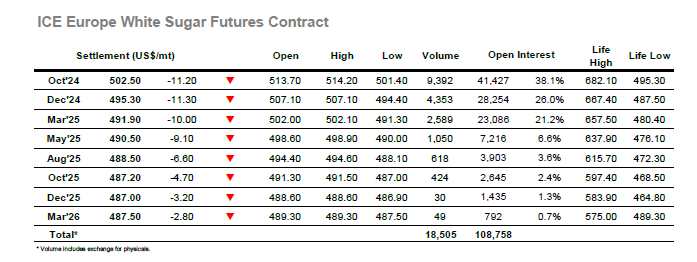

The white sugar market continued almost uninterrupted at the open today, with the prompt October contract immediately under pressure. Brief flurries of buying provided an element of stability as we approached $505 and the arrival of US traders to proceedings. With somewhat aggressive buying in the raw sugar market we saw a brief spike higher in the whites. With much of the market looking to crop risk due to dryness in Brazil there was clear interest to reverse the downward trend, however this proved once again fruitless, and throughout the afternoon we drifted lower and ever closer to the $500 mark for the October contract. It is worth noting that the raw sugar market managed to find a foothold across the afternoon where the whites faltered – the white premium bearing the brunt and compressing to $115 in the VV4, $107.5 in the ZV4 and $97 in the HH5.