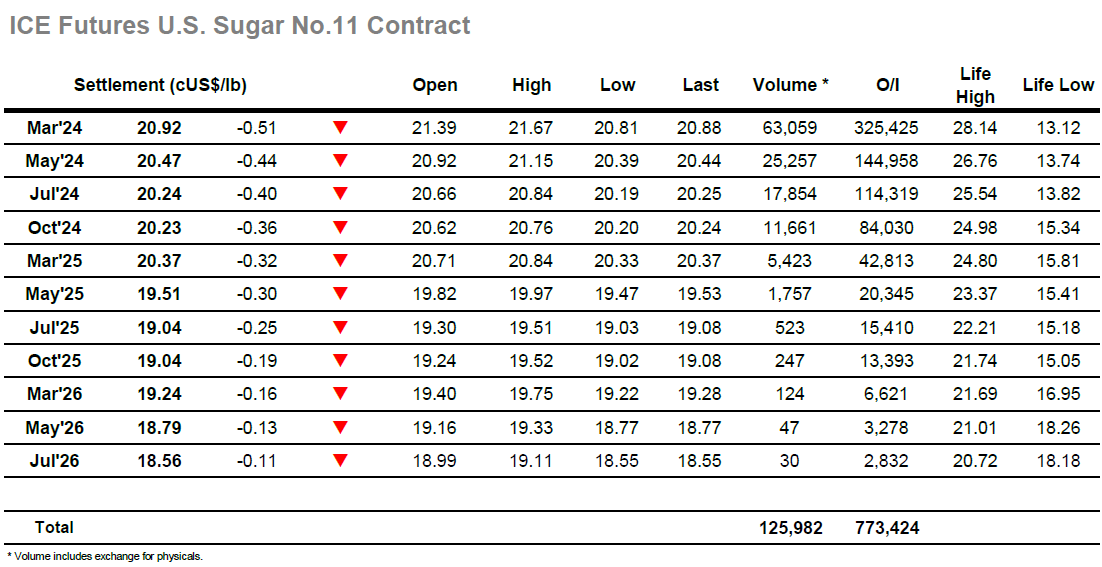

There was a remarkably calm start to proceedings today with early trading centred around last night’s 21.43 closing value and the early volume suggesting that there were few willing participants aside from the usual small specs / day traders. The sideways pattern maintained throughout the morning, and it was only with the arrival of the Americas traders that a little buying filtered in to take March’24 upward to 21.67. In the last couple of days it has felt that an increasing number of potential participants have ‘checked out’ ahead of year end, and so with no buying of any substance following the push there was a degree of profit taking that nudged prices back down to the range and another period of quiet consolidation. This was broken during the later afternoon with a sharp push beneath the morning low of 21.35, the move kicking the price quickly down towards 21.00 though a quick look at the volumes showed that the activity was still being driven by day traders / algos keen to generate movement through a relative vacuum of buying. The market attempted to level; out ahead of the recent lows however the latest in a long line of spec pushes sent March’24 to a marginal new low at 20.81 late in the day, with specs still determined to try and drive movements. There was some position squaring seen heading into the close but selling returned to leave settlement at 20.92 and place a vulnerable look upon the market once again.

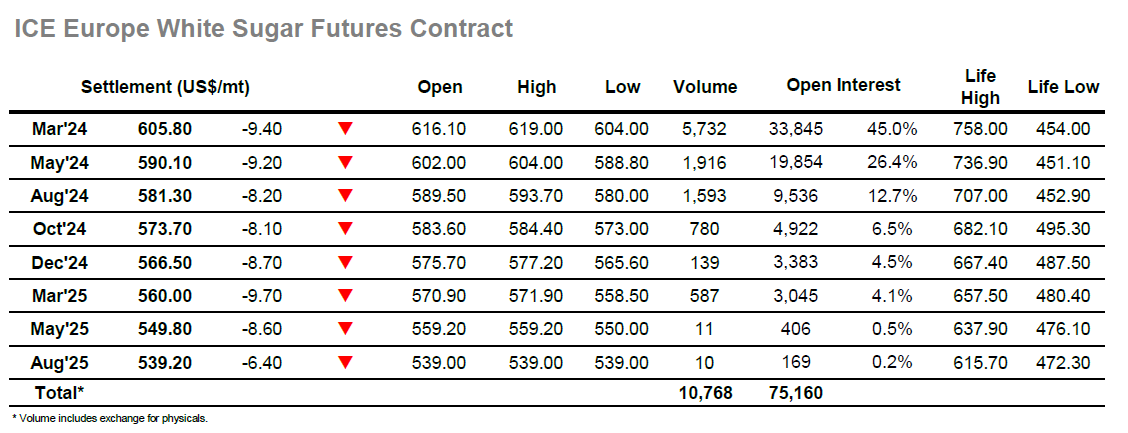

From the recent turbulence (collapse) the market has been somewhat calmer this week and that trend maintained this morning with calm trading in a tighter band. Through the morning March’24 ranged between $618.30/612.00 as small traders dominated activities, bringing some welcome respite to the environment on lower volumes. In the current climate there is no such thing as a slow sideways session and things became a little more interesting moving into the afternoon as buying emerged to push March’24 up to $619.00, though with no substantial backing the market then faltered and we fell back into the range. A second effort then came up short of the highs and so with no success being achieved on the upside the smaller specs / momentum traders turned their attentions lower with long liquidation and new shorts sending us tumbling to $605.70. This move inflicted some damage on the spreads with March/May’24 into $13.70, though the spread recovered as the market looked to stabilise moving into the final hour. Specs returned however to place new pressure on the market and bring up another new recent low at $640.00, and with settlement only just above at $605.80 we may yet see a move beneath $600.00 as year-end approaches.