March’25 started with a sizable 19.44/19.60 range across the opening moments before settling down to hold the 19.40’s for a period. This provided some welcome relief following the weakness of the market throughout this week, and while the price did dip back into the 19.30’s as the morning progressed the movement was calm against lower volume that we have been seeing recently. With specs having turned short again some exploration of the lower end was to be expected, something which occurred as we moved through the afternoon with a nudge down to 19.30, though the lows were only seen for a short period with the selling drying up quiet quickly. Prices then returned to sit quietly within the range before finding some strength as short covering occurred, sending the price up towards the opening highs. Once the cover had been taken the calm resumed and for the rest of the afternoon the market proceeded to sit on 19.50 and maintain a modest gain. It was only at the top of the board that these gains held with the day seeing a recovery in the March’25 spread values, May/May’25 moving up to end the week at 1.46 points. March’25 settled at 19.51 to conclude an inside day on the charts as we move towards Christmas.

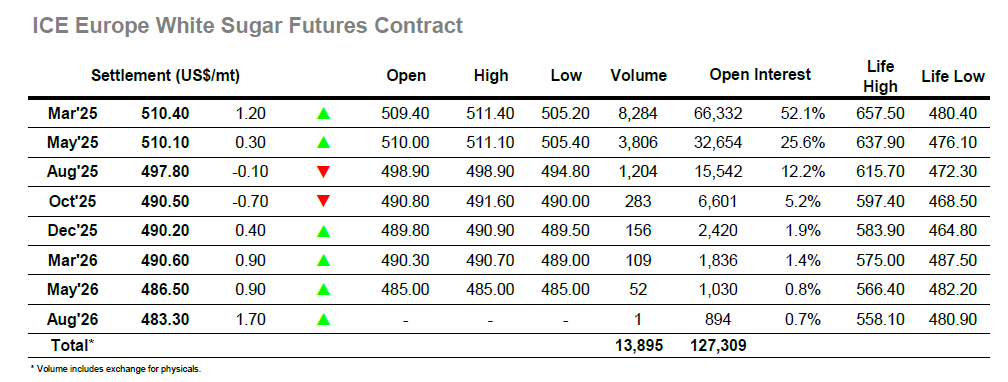

The whites got off to a stuttering start this morning, holding sideways for a while before dropping down to a low at $505.20. This pushed the white premium values back in a little with March/March’25 returning to the upper $70’s to halt its resurgence with the market otherwise quiet as traders kept interest light ahead of the Christmas period. For several hours, the price held a narrow range climbing slightly from the lows but taking until the middle of the afternoon to bring the price back over $508.00. This did at least draw out some additional buying / short covering which moved the price ahead to a high at $511.40 with a little more pace before stalling. With the market at the upper end of the range we also saw the March/May’25 spread back to a very small premium, but with the newswires quiet it was an otherwise slow end to the week. The usual end of day shenanigans resulted in a March’25 close at $510.40, sending the market into the shortened Christmas week having stemmed the decline for the time being.