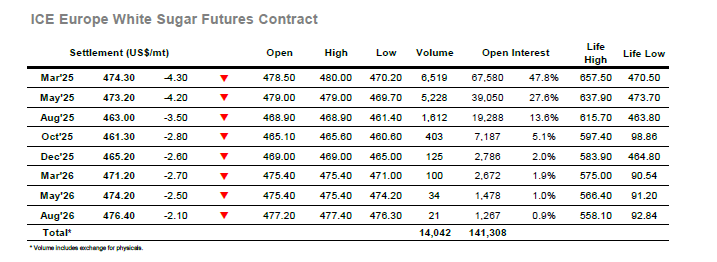

With no No.11 market to provide indication the market commenced showing little change, however the situation quickly changed as sellers emerged to continue the recent technical pressure which dominates the picture and send March’25 back to the lower $470’s. With last Wednesdays $470.50 mark acting as a target the pressure maintained for a couple of hours and the market briefly touched below this mark at $470.20, but having failed to spark and sell stops or other reaction the day traders decided that it was time to cut and run with some short covering bringing the price back up to $474.00. This settled things down with the following hours then spent consolidating to the centre of the range on low outright volumes, instead seeing the larger interest in the March/May’25 spread where rolling interest is gathering ahead of next month’s expiry. The spread held a narrow band with the volumes well matched from both sides and continued at a small premium through the afternoon with activity elsewhere remaining minimal. There was little change to this scenario as the session petered out calmly to leave a March’25 settlement at $474.30, by no means as poor as appeared likely this morning but still negative and indicating initial losses for No.11 upon its resumption.

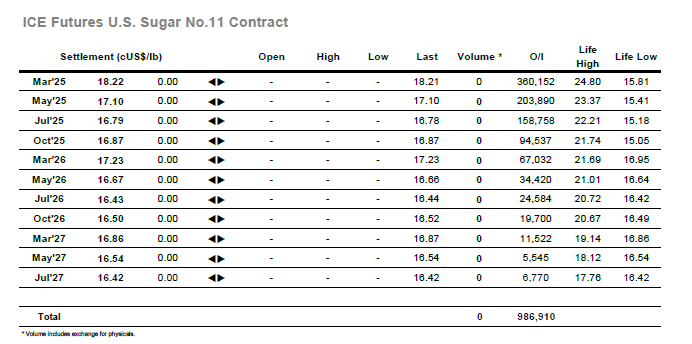

No.11 market is closed today due to Martin Luther King Jr. Day holiday.