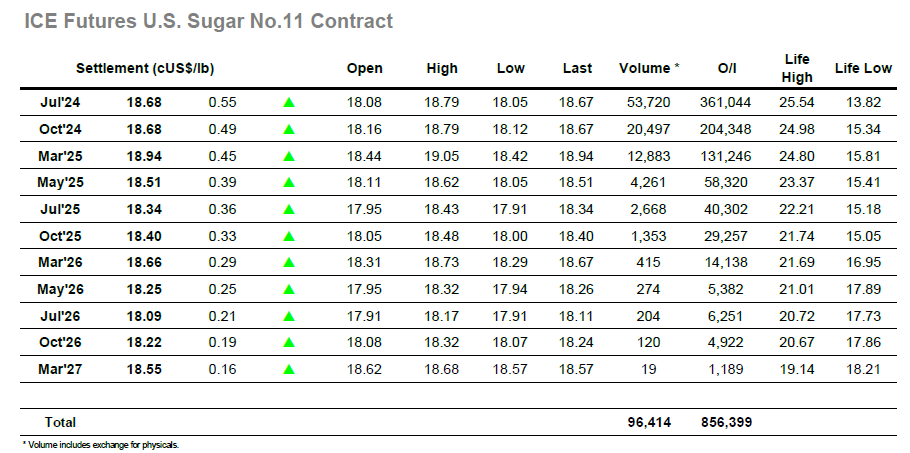

There was mixed activity as the week got underway with Jul’24 swinging between 18.05/18.23 over the first few minutes, though as things settled the market looked to work higher with trades in the 18.30 area. Lower levels had drawn out more buying interest and with Friday’s COT report showing the spec sector short holding having grown to -72,541 lots as at last Tuesday there will be questions raised as to how much more can be sold unless the larger funds look to sell more aggressively. Progress was maintained with steady increase seeing Jul’24 rise to 18.49 just after noon, placing attention to the Americas to see whether this would yield a continuation of short covering / draw any grower pricing / neither of the above. Initially there was no reaction, however moving further into the afternoon the market saw additional short covering which pushed the price upwards again to a daily high at 18.79. Volumes were moderate at best and so the quantity of short covering will not have been overly significant, however it will have made a small dent in the growing position which is expected to stand at a heavier short than reported given the continued market weakness late last week. With the highs set there was some small trader selling / long liquidation but little else, and so the market remained comfortably higher with a settlement recorded at 18.68. Technically Jul’24 still need to climb back above 18.97 to bring the picture away from its negative slant, leaving more work still to do if we are not to remain in the doldrums.

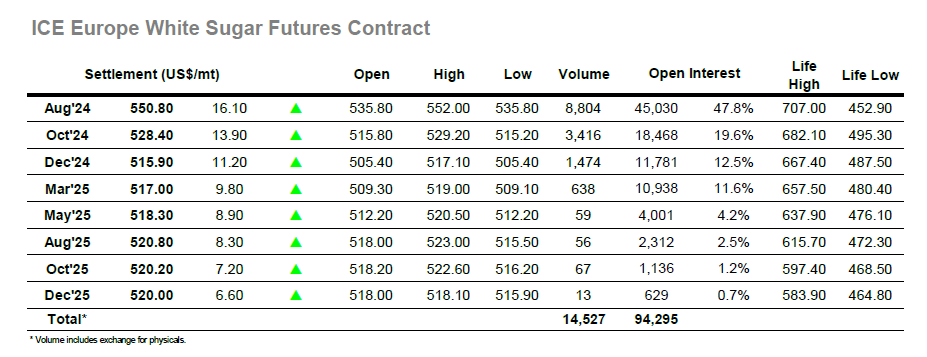

The lower trend which has seen whites dictating recent direction was soon forgotten as Aug’24 found some early buying and surged almost $10 higher to $544.40 during the firm twenty minutes. These gains were then maintained throughout the rest of the morning as consumer buyers combined with short covering to provide sufficient support and present a less negative picture than that we have become accustomed to. The price had risen above $547.00 b early afternoon before some day trader liquidation knocked the value back into the range, however its impact was brief and as the afternoon developed the recovery continued. Aug’24 extended to a high at $552.00, and the gains were not just confined to the flat price with the generally resilient spread values finding their way back higher with Aug/Oct’24 making intra-day highs at $24.10. The Aug/Jul’24 arbitrage was meanwhile resurgent, reversing recent losses to $130.00 and surging back above $140.00, while Oct/Oct’24 extended towards $117.00. The final couple of hours saw the flat price maintain at the upper end of the range, and while more work will be needed to reverse the negative technical picture a close at $550.80 for Aug’24 will provide some encouragement to those courting higher values.