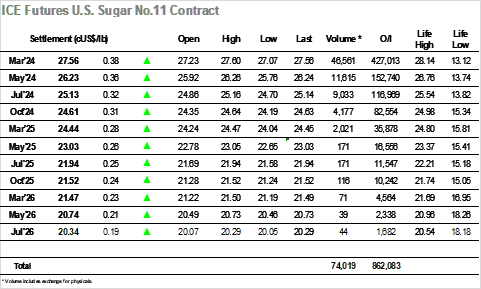

The day began slowly with the market continuing the pattern set last week of tight trading ranges centred around the teens for March’24. There was little volume being seen versus physicals on wither side of the market and so prices remained little changed as we reached noon. Light selling then emerged and sent March’24 down to 27.07 as we moved into the US morning, where spec buying emerged to quickly reverse the losses and set the price moving to new daily highs. Fridays COT report showed a small increase in the net speculative long position to 190,586 lots, a position which is likely only lightly changed since with the market having held flat over the three sessions that followed, however that did not deter the specs from continuing to push from the long side through the afternoon. March’24 climbed steadily to reach 27.50 before falling back into the range against profit taking, however the dips were being well supported with the longs determined to take the market away from the recent lows. To this end they were successful with a late push sending the price spiking to 27.60 on the call as more sizable buying was thrown into the mix. Settlement was made at 27.56 and longs will no doubt be keen to keep building though similar recent moves have capped out and at present it remains to be seen if the necessary trade buying can be found to make this effort any different from yet another range swing.  The week commenced with some light buying enabling moderate gains to be made, with March’24 edging to the upper $730’s where the price meandered along quietly. The cam was broken by a small nudge down to $735.40 early in the afternoon, however the sentiment was proving to be more positive that seen during last week and so things soon turned around with a push beyond $740 and new daily highs. There have been few reasons to be positive over the past week however the specs appeared attuned to attempting higher again and their efforts through the afternoon enabled March’24 to reach the $745.00 area before stalling. It was not just the flat price which saw positive moves with the white premiums also benefitting from the buying as March/March’24 traded above $139.00 and May/May’24 to $150.00. Prices slipped back from the highs during the later afternoon against day trader liquidation however a final twist saw another wave of spec buying force March’24 to a new high $747.40 on the close, with settlement made just below at $746.40 to set the market well for a challenge of the upper end of the recent tight band.

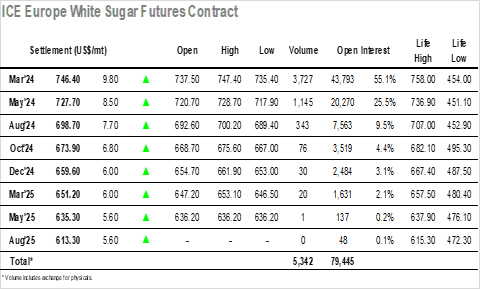

The week commenced with some light buying enabling moderate gains to be made, with March’24 edging to the upper $730’s where the price meandered along quietly. The cam was broken by a small nudge down to $735.40 early in the afternoon, however the sentiment was proving to be more positive that seen during last week and so things soon turned around with a push beyond $740 and new daily highs. There have been few reasons to be positive over the past week however the specs appeared attuned to attempting higher again and their efforts through the afternoon enabled March’24 to reach the $745.00 area before stalling. It was not just the flat price which saw positive moves with the white premiums also benefitting from the buying as March/March’24 traded above $139.00 and May/May’24 to $150.00. Prices slipped back from the highs during the later afternoon against day trader liquidation however a final twist saw another wave of spec buying force March’24 to a new high $747.40 on the close, with settlement made just below at $746.40 to set the market well for a challenge of the upper end of the recent tight band.

Daily Market Price Updates and Commentary 20th November 2023

Become a Thought Leader on our App

Are you an industry expert in:

• Soybeans

• Grains

• Dairy

• Fruit

• Freight

• Orange Juice

• Nuts and Seeds

• Fertilisers

• Carbon

We’re looking for leading voices who want to contribute their expertise to a global audience.

Find out how a partnership with us works below.

Related content

Daily Market Price Updates and Commentary 14th April 2025

Raw Sugar Update The week commenced with Jul’25 still sitting at...

Sugar Futures and Market Data: 14th April 2025

Insight Focus The raw sugar futures traded lower last week. Both produ...

Dry Weather Aids EU Beet Plantings

Insight Focus European beet plantings are happening rapidly. They’ve...

Daily Market Price Updates and Commentary 11th April 2025

Raw Sugar Update It was with some relief that the market posted a calm...

Daily Market Price Updates and Commentary 10th April 2025

Raw Sugar Update After yesterdays close the news of the latest Tariff ...

CS Brazil: Sugar or Ethanol? 9th April 2025

This report is updated weekly, for daily information refer to our Busi...

Daily Market Price Updates and Commentary 9th April 2025

Raw Sugar Update Following yesterday’s weak technical showing the ...

US Sugar Market Finds Some Support in Tariffs

This update is from Sosland Publishing’s Sweetener Report. For more ...

Want to learn more about Sugar

The Raw Sugar Futures July-October Spread

Welcome to the sixth instalment of Czapp’s course on futures market ...

The Raw Sugar Futures May-July Spread

Welcome to the fifth instalment of Czapp’s course on futures mar...

The Raw Sugar Futures March-May Spread

Welcome to the fourth instalment of Czapp’s course on futures market...

The Raw Sugar Futures October-March Spread

Welcome to the third instalment of Czapp’s course on futures market ...

Biomass: The Future of Renewable Energy

What is Biomass? Biomass is a fuel derived from organic material such ...

What Factors Influence Futures Market Spreads?

Welcome to the second instalment of Czapp’s course on futures ma...

Identifying Relationships in Commodities With Machine Learning

Insight Focus We have used machine learning to research commodity mark...

What is the Carbon Border Adjustment Mechanism?

Insight Focus Importers of carbon-intensive materials to the EU will p...