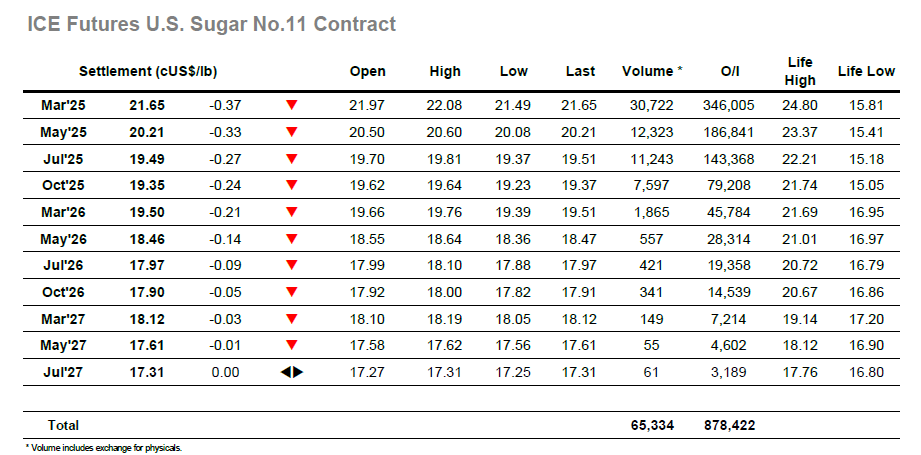

A mixed opening based upon apathy was followed by a small dip to the 21.80’s, though the movement was based on market drift / disinterest with such environments commonly seeing values ease away. A morning of consolidation then ensued, based on very low volume and with the spec sector still not showing intent to hold any significant position it was tricky to see where any interest would come from. A nudge back up to 22.02 occurred during the early part of the afternoon with smaller traders looking to generate interest from the US, but when nothing was forthcoming the inevitable liquidation followed and sent us down to new daily lows. A small spike down to 21.64 satisfied the intra-day charts by marking a 50% retracement of the recent 20.86 / 22.42 rally, although that did not prove to be the end of the decline as new losses were made following a pause. Spreads were a touch weaker with March/May’25 seeing a daily low at 1.42 points, a still significant value which represents the Q1 physical outlook. Having registered a low at 21.49 ahead of the close the market saw some late short covering which reduced the loss slightly and generated a settlement level at 21.65, bringing a slow day to a close.

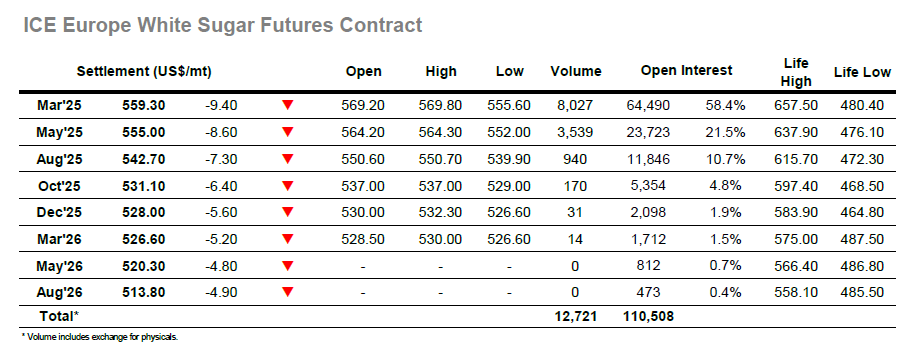

higher opening prints were brief, and the market soon started to erode further down the range as a wider lack of interest drew some selling. Some light but supportive buying appeared beneath $563.00 and provided the opportunity to pause and take stock of the situation, but still the longs were nowhere to be seen and so prices simply edged along sideways for the duration of the morning. The afternoon brought some light buying and a small nudge away from the lows, but this lacked substance, and it was not long before the lower path resumed. There are few reasons to find enthusiasm now that the recovery has stalled, and so the rest of the day became built on the activities of the spec sector, some mild selling based on position reduction and a day trader short play about the only highlights in a very dull afternoon. March’25 slipped to lows at $556.60 and in so doing dropped March/May’25 back to $3.60, but the reality was that it meant little with the outright value still some distance above last week’s 2-month lows. There was some covering from smaller traders during the later stages which allowed values to pull a small way above the lows heading into the close, with March’25 settling at $559.30.