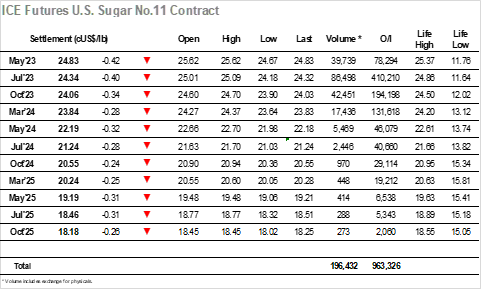

A remarkable start to the day saw Jul’23 trade to a new contract high within the first minute but against mixed activity find itself down at 24.54 just 20 minutes later. There are so few resting orders now in place from either producers or consumers that the environment carries the potential for constant volatility and while things calmed for the rest of the morning with Jul’23 edging back away from the lows it felt that there would be further movement to follow. With the early afternoon producing no spark from the US it was the downside for a rare change with a move to new lows, and while the move was again on moderate volume once spread and algo factors were considered it seemed that those squeezing were prepared to let things go, maybe in consideration that some correction serves to take a modicum of pressure from the overbought indicators away. The decline extended to 24.18 before some pricing started to reappear and provide support, a sign that some consumers may be less confident in prices coming back anywhere near to the lower 20’s and so just want to move some pricing along for fear of being forced to cover higher again. Tonight, will see the latest COT data published, though expectations are that this will likely show only a small increase in spec holdings with the trade widely considered to be the prime instigators of the rally, another factor of concern for the consumers with no prospect of a correction based on spec liquidation or stops. There was a small element of movement away from the lows during the final stages which left Jul’23 settling 24.34, a long way shy from the morning high and suggesting that we may see some consolidation when we resume next Monday.

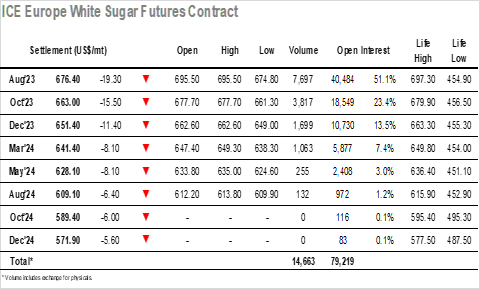

Initial prints at $695.50 were swiftly followed by trades beneath $690 as light opening selling had a significant impact upon the price. The market calmed soon after and looked to consolidate in the upper $680’s, but with buying appearing to be a little thinner than of late the market gradually creaked a little more with losses of $13 incurred before efforts were made to pick things back up towards the end of the morning. Recent days have seen the bulk of the upward movement generated through the afternoon, and so there was rightly some expectation that another such push could manifest as Aug’23 pulled back towards $690, however with pressure being exerted upon both the nearby spread and white premium the price once more fell back, and in so doing encouraged a little more selling from longs. New session lows were soon recorded as the lack of resting orders meant there was little to no support, a factor which became increasingly apparent as the price further declined to $674.80 to wipe out all of yesterdays movement. By this stage, the Aug/Oct’23 spread had declined to $13.10 while the Aug/Jul’23 premium had taken a pummelling to stand at $141.00, a mere correction but one which will raise questions as to whether the highs have been seen for the time being. There was no sign of any resurgence at the end of the day to leave Aug’23 settling at $676.40 and while that remains a high level there may be some disappointment that prices fell so sharply from the new highs as we head into the weekend.