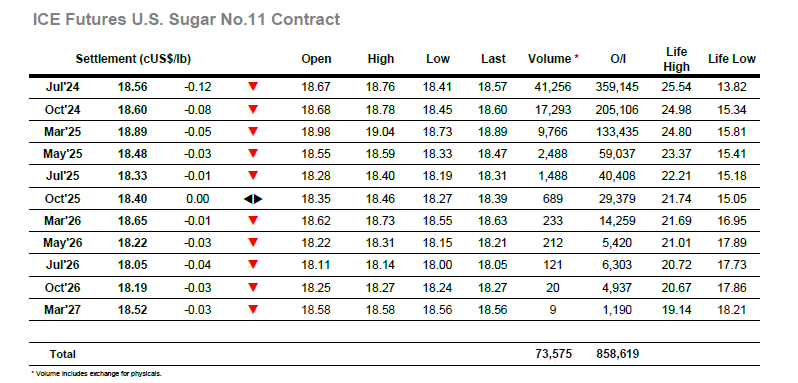

It was another mixed opening for Jul’24, though as things settled down the price levelled out just above unchanged to show single digit gains for a period. Highs were recorded at 18.76 on three separate occasions, though by late morning, with no sign of any fresh buying, there was a retreat into the red and the mid 18.50’s. The start of the US morning drew no additional activity and so the market set about flatlining in the 18.50’s on miniscule volumes. Small movements to 18.67 and 18.41 were swiftly reversed, leaving the dull sideways trend to endure right the way through to the closing stages. There were similarly small movements for the spreads where Jul/Oct’24 returned to a small discount, but little more than that as an inside day played out. There was a small move to 18.62 ahead of the close though Jul’24 settlement was appropriately made at 18.56 to maintain the 18.50’s dynamic, concluding a very slow day and leaving traders hoping for something more interesting tomorrow.

Opening buying saw Aug’24 print up to $555.00, though most of the gains were given back immediately as the market settled into a narrow band near to unchanged levels. The higher opening values also led Aug/Jul’24 to be briefly printing around $141.00, although the value dropped back by a couple of dollars as the market settled down. All remained calm until late morning when prices stepped a few dollars lower on deceptively light selling, with the failure to build on yesterdays recovery clearly denting confidence once more. Prices levelled out in the $545.00 area, and most of the afternoon was spent near to this value with only a few small nudges moving the price briefly away by a couple of dollars. There was movement for the white premium values though as the lower flat price hindered their recovery, and by late afternoon Aug/Jul’24 was sitting at $135.50 with Oct/Oct’24 at $114.00. Outright values remained sideways through the close, bringing a slow session to an end with Aug’24 settling at $544.40.