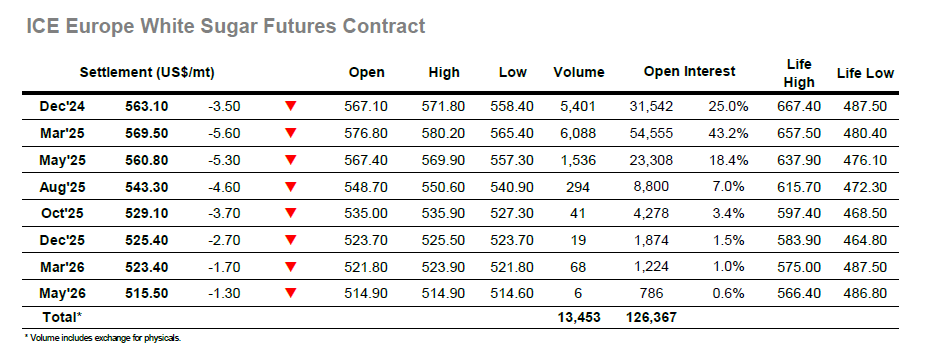

There was buying around as the new week got underway and this helped March’25 push up to 22.35 before pausing. Fridays COT report had revealed a small rise in the net speculative long holding to 56,445 lot, in line with expectation across the reporting period, and while subsequent sessions have seen prices drop back down the range the low volumes changing hands suggest that much of this position remains. As the morning wore on so there was a decline which sent prices briefly into the red, though light buying from the US reversed the move and saw a return to the morning highs. Volume was painfully thin throughout these moves and only picked up to vaguely respectable levels during the afternoon when prices slipped back to new session lows. Long liquidation drove values downward to challenge last weeks 21.71 mark, and this was broken with new lows made at 21.63, though notably there were no significant stops at the bottom which enabled consumer pricing and day trader covering to then provide support. Prices recovered only marginally into the 21.70’s with nerves clearly showing amongst longs and their lack of impetus meant that prices were still sitting at the bottom end of the range as we approached the close. A little more position covering in the closing stages did lift March’25 back to 21.86, though settlement value at 21.83 will keep the nerves jangling amongst the longs who may look to liquidate further should the lows break again.

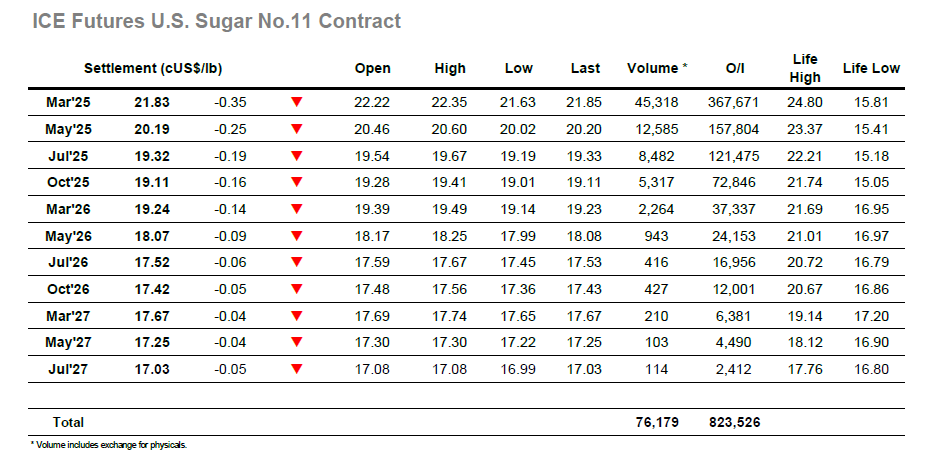

Dec’24 shot upward in the opening moments to provide a firm base from which to try and build for the day ahead by bringing the price back above $570.00. This area held for a while but gradually the lack of meaningful buying allowed values to drift back down through the early range to suggest that last week’s apathy may well continue. The arrival of traders from the Americas caused prices to chop around a little more actively, but though they rose back toward the morning high market there was again a lack of substance to continue the progress. White premium values were holding a little more firmly than overnight, but that alone was insufficient to keep the market up and as the afternoon progressed, so the flat price started to fall back. Having dropped through the lows there was an increase in the rate of decline due to spec liquidation, and while the volumes being sold were not that large the thing environment meant that the price quickly slipped back down to $558.40. This was still a few dollars above the recent lows which provide initial support, and so as things calmed the market was able to stabilise to head into the close above $560.00. There was some late buying which meant a close at $563.10, while the March/March’25 white premium ended the day more than $2 up at $88.25.