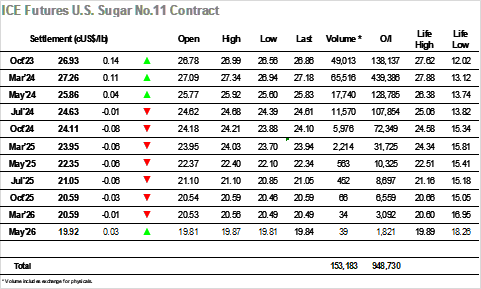

The market continued yesterday’s movement with an opening tumble to 26.94, illustrating a lack of overnight physical interest despite the drop in values. The market attempted to make a recovery soon afterwards though this topped out around 27.20, leaving Match’23 to edge along quietly ahead of 27c for the rest of the morning. There was a pickup in activity once US traders arrived with a short spell of spec buying taking the price to 24.34 until an equally pacy collapse had the market flirting with the morning lows once more. The specs were not to be deterred in their efforts and across the following hours the market mounted a slower move back toward the highs, eventually matching them before slipping back into the range, with the fact that only the front three prompts were tracking higher showing the limited nature of the effort. By the close we were seeing Oct’23/March’24 printing marginally higher at -0.33 points, which March’23 settled mildly higher at 27.26 to be well situated heading into Friday.

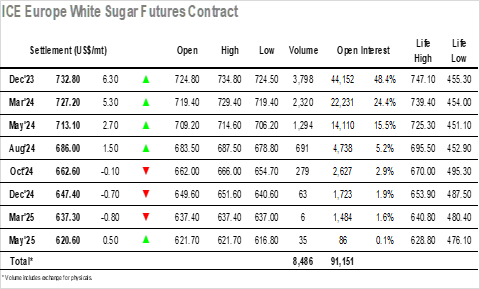

Over recent sessions the market has struggled to move very far from the $730.00 area, pivoting either side on mixed activity as specs dominate proceedings. Despite an early drop to $724.50 that same broad pattern was maintained with Dec’23 soon working back up to $731.00 and treading the same ground. The rest of the morning proved to be quiet with prices ambling within the early range, the quiet being welcomed by some following recent volatility. The quiet was broken with a brief spike to $734.60, and while that was not sustained it did awaken some spec interest leading the market to work upwards again as the afternoon moved along. The strength of nearby positions was also bringing the first positive movement for white premiums since the expiry with March/March’24 trading back above $127.00, while the flat price recorded a marginal new high at $734.80. The closing stages played out to the upper half of the range to see Dec’23 settle at $732.80, a solid performance which will please the longs.