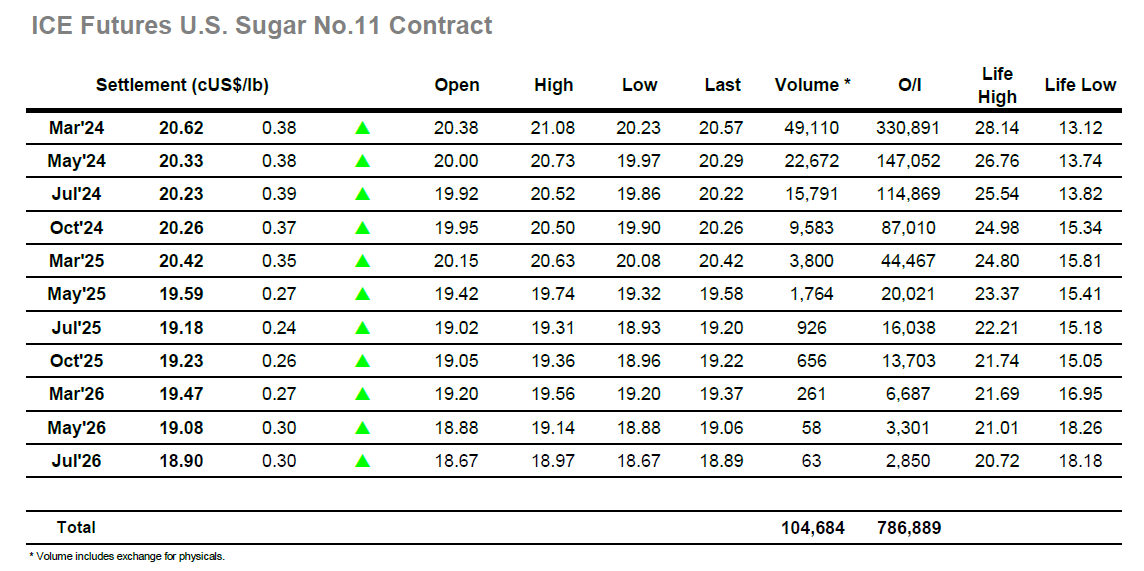

Today No.11 opened at 20.38, 14 points above yesterday’s settlement, reaching 20.50 near opening. Market traded sideways around these levels until 10am, when saw some correction towards 20.25 zone. Recovery to the 20.44 was seen and another quiet hour of trading was seen until 12h30pm near the whites market early close. At this time, with America’s opening, market saw a more buying volumes coming bringing un upside move that led no.11 to breach 20.50 zone, trading at 20.70. At 5pm, market saw further buying that led to the daily high at 21.08. Following minutes market came back below 21c and into settlement zone aggressive selling took place with more than 3k lots liquidation, erasing most of the afternoon gains. Market closed at 20.57. Settlement price was 20.62, 38 points up from previous settlement. Volume was smaller compared to recent days, with 49k lots traded. H4K4 spread closed at 0.29.

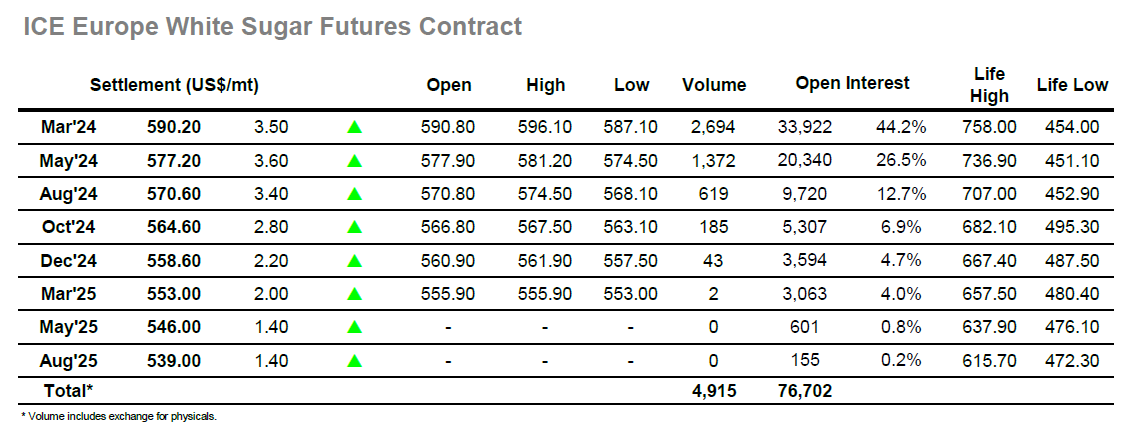

Today whites market had reduced hours session, opening at $590.8, up $4.1 from yesterday’s settlement. Buying interest kept acting after the opening, and at 9am, market was trading near $592. Further gains were seen in the next hour, until the daily high at $596.1, registered at 9h45am. From that time onwards, market saw some correction, giving back some of the gains. At 11am, market was trading near $590.5 and traded sideways until closing at 589.50. Settlement price was $590.2 a $3.5 gain from previous session. Volume traded was 2.7k lots and H4H4 white premium closed at 135.6.