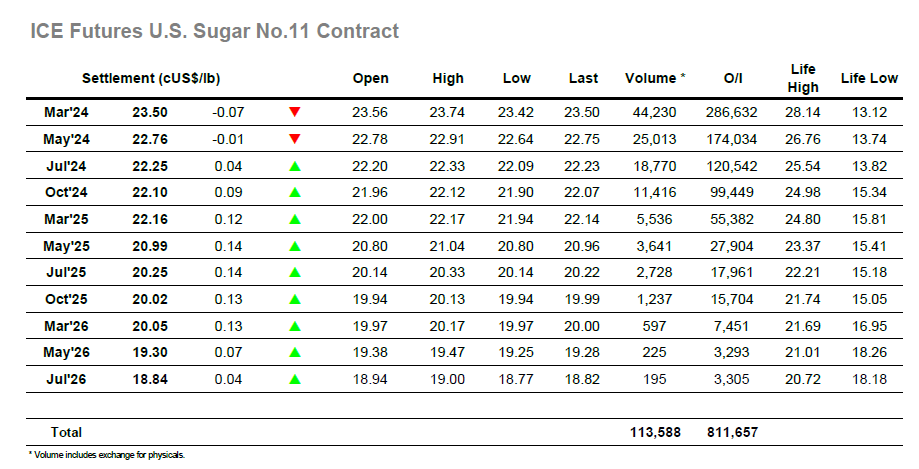

A wild opening saw March’24 quickly swing between 23.64 and 23.44, though things soon settled with prices holding neat to Fridays 23.57 closing value. Specs have been more active recently and though the most recent report showed only a modest increase in the net spec long to 12,447 lots, the huge price rise over the three sessions which have elapsed since will see this number significantly higher on a “live” basis. It was to be expected that the market began to work higher again and March’24 extended to 23.74 midway through the morning though lacked any sustained buying and so fell back against day trader liquidation. The decline was sharp and saw a new low at 23.42, though the movement then reversed, and we ended the morning back around unchanged levels. The start of the US week didn’t bring any new interest and so the afternoon developed into one of rangebound activity with low volumes prevailing as smaller traders chopped about within the established parameters. Volume only ticked up to moderate levels due to spread activity with March’24 spreads giving back a few points as selling was encountered and many losing interest on proceedings. There was a nudge down to 23.45 ahead of the close though sufficient buying was in place to close just 7 points lower at 23.50 and bring a dull inside day to a conclusion.

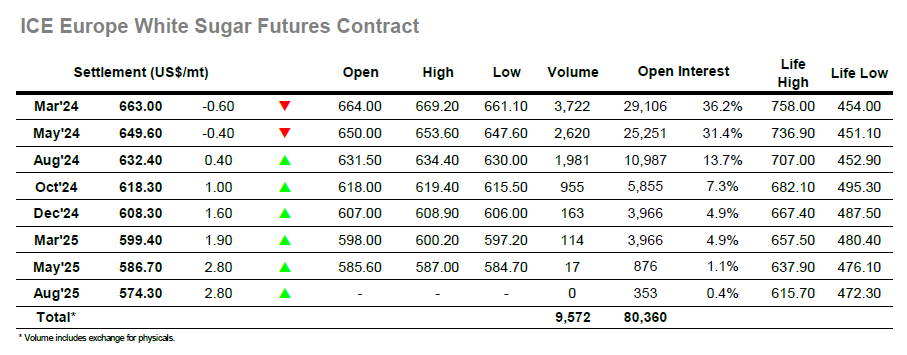

It was a broadly positive start to the week with smaller specs once more looking to set the narrative, with their efforts combining alongside some consumer interest to take March’24 to a morning high at $669.20. Notably there was not the same level of support as had been present last week, which brought the rally to an abrupt end once prices had failed to push on after breaking above Fridays $668.40 high mark. The liquidation sent the market back by some $8 in short time, though once concluded values settled down into the range and the picture calmed somewhat. Trading continued broadly sideways though there was never any threat to the earlier highs, and with the lower end showing more vulnerability new daily lows were seen at $661.10. Spreads were proving subdued today and saw lower volumes, with very little change to nearby values, while for the white premium the flat price moves were seeing March/March’24 tip between $143.50 and $145.00. Heading into the close we saw values drop back to the lower end of the range, and a slow day concluded with March’24 showing a very small net loss at $663.00.