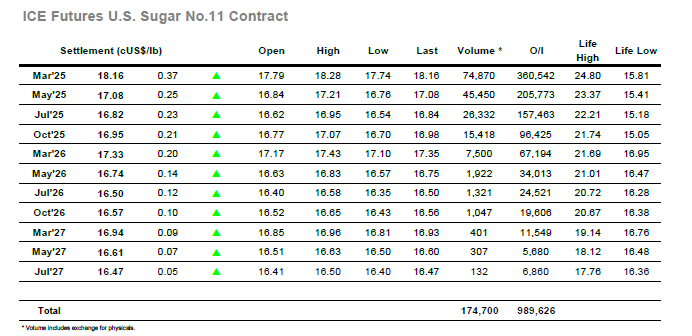

It was a far more subdued start to today’s session as the dust settled on another sharp decline with March’25 spending the first two hours of trading within a narrow 17.74 / 17.86 band. While unspectacular this provided the platform for buyers to emerge during the late morning and take the market back up to the 18.00 area, a steady move though unlikely to worry the fund/spec shorts given the scale of decline over recent weeks. There was another period of calm as those in the Americas joined the fray though with March’25 maintaining away from the lows against assorted bargain hunting from consumers another look higher followed, this time assisted by some short covering from the faster moving sector of the specs. Through the afternoon this activity saw the price rise above yesterday’s session high and reach 18.28, though progress stalled later in the afternoon as day traders cleared back out of positions and sent the price back towards 18.00 once more. Even as the market came off the highs, we saw spreads maintaining their daily gains with March/May’25 back up to 1.06 points, though as with the flat price there will be questions as to whether this represents a turnaround or simply another false dawn while the market pauses for breath. A close at 18.16 unwinds most of yesterday’s loss though having not recorded consecutive upward sessions yet this year there remains much work to do to reverse the current trend.

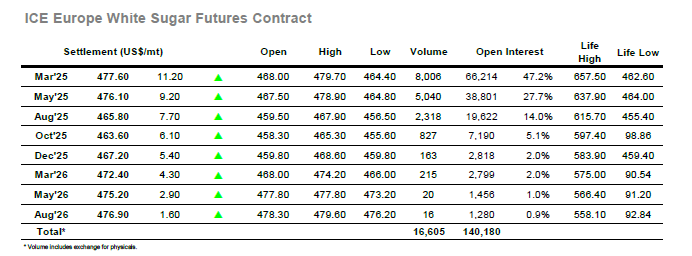

A small amount of initial choppy trading was quickly over, and the market settled down to hold on to mild gains through the early morning on calm volume, with traders seemingly re-assessing the picture after yesterday’s performance. By the middle of the morning the market began to tick up a little higher and soon gathered pace to move to $474.50 by noon on mixed buying, though progress then stalled with consumer buying less prevalent away from the lows. The March/May’25 spread was trading more firmly on the move as it continues to swing either side of parity, although volumes were lower today than in recent sessions. Moving through the afternoon the upward tone was maintained although the pace of increase slowed to a more pedestrian level as March’25 eventually reached a high at $479.70 with around an hour of the session remaining. This did enable the March/March’25 white premium to regain some ground and work back towards $78.00, while the March/May’25 spread reached a widest $2.50. There was a blip during the final hours as some small trader positions were squared away but the tone was positive into the close and the day ended with March’25 at $477.60, the question now being whether there will be any continuation or if it simply becomes another false dawn.