The past four sessions have seen a succession of negative days for the market and though the price was marginally firmer during early trading there was no sign that this situation would reverse with the buying mostly coming against physical hedging. All remained calm for a period, however by late morning the downward trend resumed with spec selling providing the impetus and pushing into a limited amount of scale buying. Friday’s COT report showed a small reduction in the spec holding to 1,381 lots log as of 16th July, though with the market now more than a cent beneath last Tuesday level it seems certain that this has now swung back to the short side with todays activity increasing the number. Through into the early afternoon the Oct’24 price levelled out in the 18.30’s and the picture calmed with the specs showing no desire to cover back shorts and bring prices back. Later in the day there was some small extension for the range with lows recorded at 18.25, however with some larger buy orders having emerged a stalemate ensued which maintained for the rest of the session. Most traders seemed content with positions leading to a calm close, sending Oct’24 out at 18.30 to provide another poor showing on the charts.

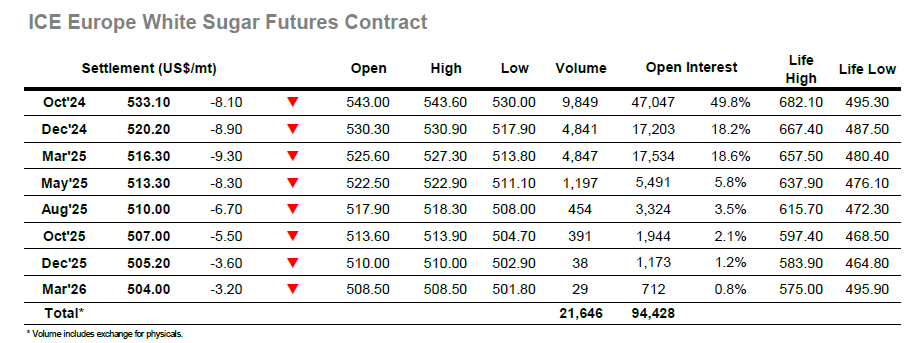

The new weeks started with some supportive buying at the top of the board as physical activity at the lower levels drew hedge lifting, and this maintained Oct’24 in the low $540’s through the first couple of hours. Recent days have seen buying from other sources lacking and this became apparent later in the morning once the physical risk had been covered as the price slipped back to Fridays $538.50 low. There wasn’t a hint of any buying against the technical side as this level passed in an instant, and suddenly the market was unable to find a toe hold with more spec selling/long liquidation sending the price back to $533.00 before pausing. There was some better volume from pricing orders in this area and so the market was able to consolidate through into the afternoon although tellingly there was no sign of any reversal. The rest of the session saw the market drop a few dollars further to record daily lows at $530.00, but there were no fireworks and trading remained orderly and rather slow. White premiums did see some fluctuation on the earlier movements with Oct/Oct’24 trading down towards $126 intra-day though by the close it was showing little change from Fridays value at $129.65. Oct’24 settled away from the lows at $533.10, to conclude the latest negative performance.