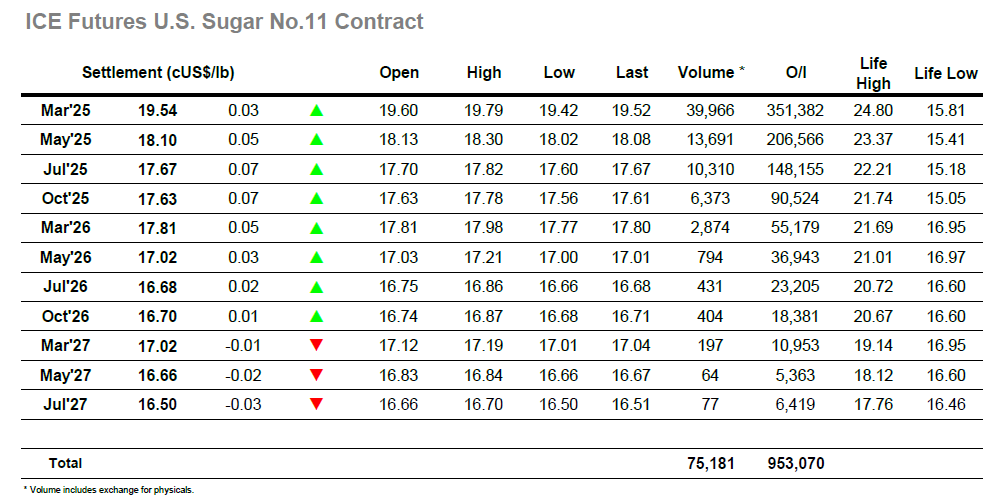

A slightly higher call was indicated on the pre-open and the market obliged with the opening moments seeing March’25 trade between 19.55 and 19.72. Sentiment was more positive than across the last couple of weeks and the trend remained positive through the early part of the morning to extend the band up to 19.79 and allow for a period of consolidation. The motivation may have originated from the COT report which showed significant selling across the 5-day period to turn the net spec holding to -34,736 lots short, the makeup of this movement being an even mix of new selling and long liquidation. It was interesting to see that there was also an increase in the index long over the week, suggesting some pre-emptive buying at the lower levels alongside the consumers ahead of rebalancing in the new year. For a few hours, the market did not move very far, maintaining gains and sitting mostly in the 19.70’s, though not showing any intent to push further north with the buyers standing back after the early push and the drift taking place against low volume. This started to tell through the afternoon as March’25 had a wobble and fell back towards unchanged levels, and then on to 19.42 as the insecurities of the market started to reappear. With the sell side proving as thin as the buy side had earlier in the day this proved to be the low and against continuing low volume the market managed to tick along in front of this low mark before rebounding into the 19.50’s late on against short covering and settle at 19.54. This activity suggests that with the Christmas holiday looming on Wednesday many traders are keeping their powder dry, making the prospect of another “sideways” session tomorrow more likely.

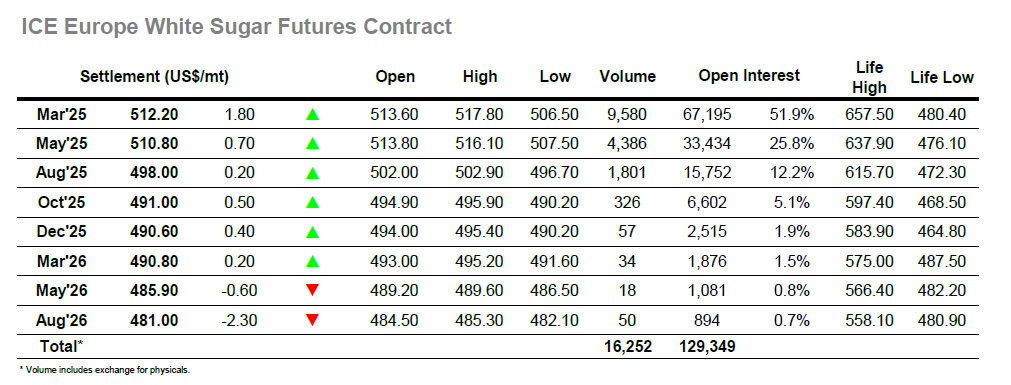

With No.11 already trading higher there was an opening jump to leave and intra-day chart gap as the market traded more than $6 higher at $516.50. This was not the end of the strength and through the early morning March’25 continued ahead to $517.80, providing some relief from the relentless losses seen through this month though only in a controlled way. This likely represented some trend exhaustion rather than a material turnaround with the volume of buying not proving overly significant, though it was sufficient to hold prices steadily within the opening range into the afternoon. White premium values were solid through this period with March/March’25 trading up above $81.50, however this value faded back into the upper $70’s moving through the early afternoon as the flat price eased back and filled the overnight gap. With confidence in the market still fragile some additional selling followed and sent March’25 all the way back to $506.50, though maybe crucially the move ended before challenging the $503.00 low from last Thursday so maintaining a modicum of stability. With the market not falling there was a round of short covering through the final hour to bring the price back upwards and end the day at $512.20, a modest net gain with which to end the day. Tomorrow sees a shortened session for Christmas Eve ending at 12:18pm London time, which may deter specs from much involvement and mean some calmer trading as we head into Christmas.