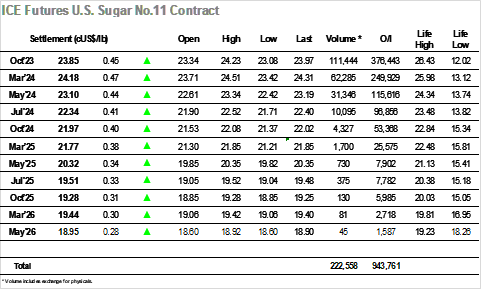

Today, the No.11 market initiated the trading session at 23.34, 7 points lower than yesterday’s settlement. This early indication raised the possibility of sugar enduring another weak day while there was with small resistance at the 23.30 barrier. Shortly after the opening, a series of selling candles emerged, causing the market to dip further to the 23.20 level. This downward trajectory persisted steadily from 9h00 am until 12h15 pm, culminating in the daily low, with Oct’23 trading at 23.08. At this point, a significant development took place as news broke that India was imposing a ban on sugar exports for the current year. This announcement triggered an immediate and substantial market response. Elevated trading volumes propelled the market to its daily high at 2h30 pm, when market hit 24.23. This represented a 115-point range upward move occurred within a condensed 2-hour timeframe. Sellers capitalized on the opportunity to offload their holdings above the 24 mark, prompting a swift decline below this level. The market’s ascent was as rapid as its fall, and by 5 pm, was trading at 23.50. The concerns regarding still quite weak demand, coupled with the absence of official statements from the Indian government, motivating sellers to act upon potential information gaps. During the final trading hour, the market managed to recoup a portion of the ground it had lost earlier, trying to close above the 24c. Ultimately, the session closed at 23.97, while the settlement price was established at 23.85. Notably, the trading volume exceeded that of recent days, with 111,000 lots traded. The V3/H4 spread experienced a slight further weakening, settling at -0.33.

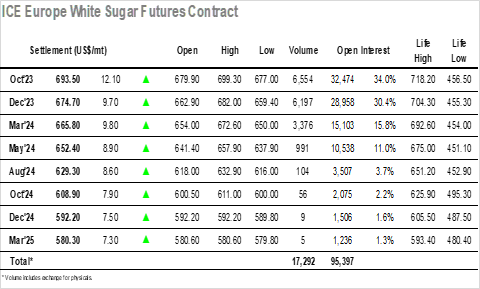

Today Oct’2023 started trading in a downward trend, opening at $679.9. This marked a decrease of $1.5 in comparison to the settlement observed yesterday. The market then kept its descent until noon, at which point reached the daily low, at $677. A significant development emerged in the form of news about India’s potential ban on exports later in the year. The news promptly led to a sharp uptick in prices, causing the market to reach its daily high at 2h30 pm, with trading reaching $699.30. Market was then followed by a subsequent moderation in momentum and a gradual decline was seen, encountering minimal resistance. By around 5 pm, it had readjusted to lower trading levels, hovering near $686. In the final hour of trading, the market tried a recovery, ultimately closing at $695.1. The settlement price was $693.5. Throughout the trading day it was registered a volume of 6.5k lots. The VZ white premium exhibited a decline of $1.63, settling at $148.15 by day’s end.