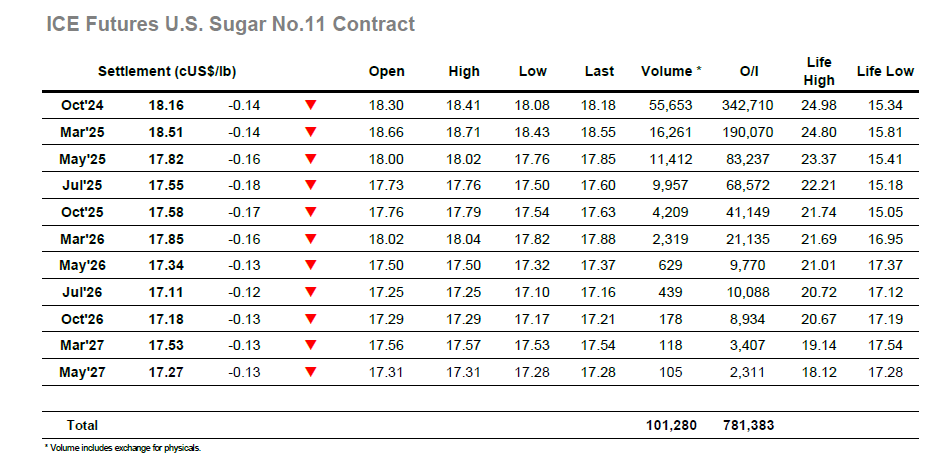

It started as another day of slow consolidation as the market edged along quietly showing no intent to move to either direction. As prices dipped, they were gathered up in the lower 18.20’s, and with the specs happy to maintain recently added short positions something of a stalemate ensued for several hours. Marginal new lows were registered during early afternoon as a little more pressure was applied, however such was the thin nature of the market that some short covering soon after prompted a rally to 18.40 though things then topped out. Such is the negative nature of sentiment that as soon as the selling resumed there was a negative path formed to new lows with Oct’24 falling to 18.08 over the next 90 minutes, the lowest price achieved since 31st May when trades at 18.03 were registered. There was some small recovery through the final two hours as Oct’24 pulled back into the teens and eventual settlement at 18.16, though it was insufficient to break the current trend with a sixth successive downward day registered.

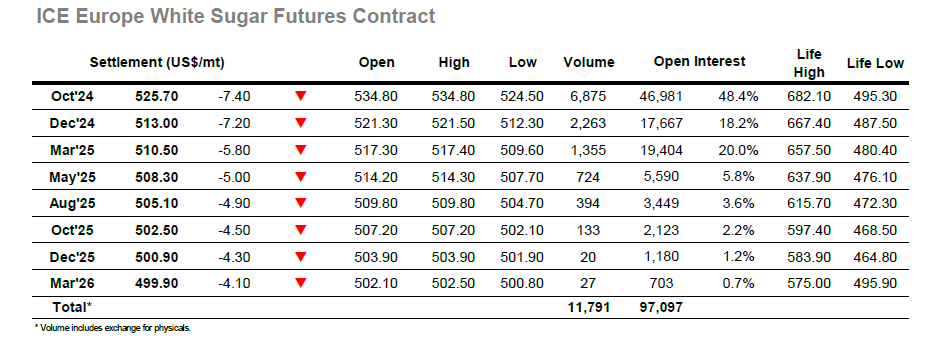

Opening either side of unchanged the market found it difficult to claw back into credit with the early part of the day spent testing support ahead of $530.00. This maintained throughout the morning on low volumes, maintaining the recent trend with few willing buyers being found outside of the usual scale pricing. The afternoon too showed little change and it was only following a forced recovery to a small credit that the market gained any momentum with some renewed selling forcing Oct’24 to its latest set of new recent lows. Pricing orders were filled in along the path to a low at $524.50, action which damaged the Oct/Oct’24 white premium with trades beneath $126.00. Though specs remain net long of the whites there is no drive to protect positions at present, and so the final couple of hours played out slowly at the bottom of the days range to cement another poor performance. Oct’24 settled at $525.70 with Oct/Oct’24 valued at $125.35, concluding another weak day and showing no sign of yet reversing the present trend.