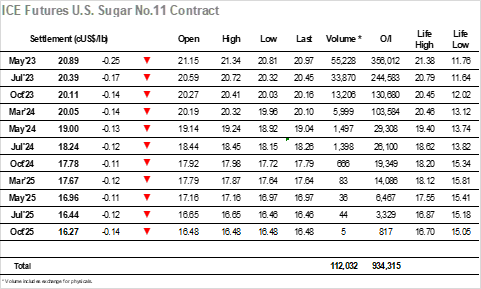

The market has performed well in recent times when viewed against a disappointing macro situation, and while early trading today was rather lacklustre it was not to the detriment of prices levels as May’23 eased along comfortably in the teens. This provided a platform from which it could again look to the highs, although it was not until midday when US traders appeared that the market received a boost and traded up to 21.34. As discussed yesterday it is merely the day traders and algo’s driving the market at present and so with no follow on buying to be found the market quickly pulled back to sit in the 21.20’s in the hope that consolidation may in turn allow for a fresh move higher, but instead it came to an abrupt end as long liquidation sent the market quickly towards 20.00. Efforts were made to defend the slide however on each occasion it ended with the longs being kicked back out and by the final hour May’23 had fallen to 20.81. There was some defensive buying (and probably a little short covering) which ensured a settlement away from the lows ay 20.89, and while a disappointing showing todays action represented an inside day so doesn’t particularly harm the picture going forward.

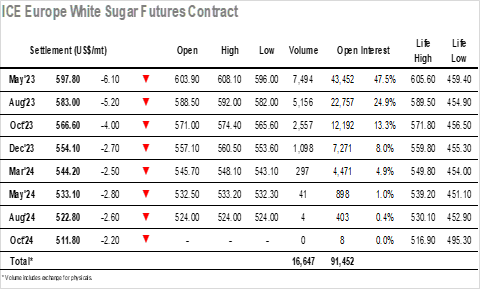

Buoyed by the strong nature of the market this week the specs once again set about playing things from the long side once they had gathered up an early dip. Progress was not so easy to come by however with a few more sell orders having filtered in overnight though that did not deter them from giving the market a push through to another contract high of $603.90 right around noon. The biggest hindrance seems to be the reluctance of No.11 to push with the same vigour and with selling continuing both outright and into the higher white premium values it was not long before we started to see a retreat with longs being sold back out. The specs are hardy souls and they did not want o let the market go, however the afternoon proved that they lack the necessary volume to hold things up single-handedly which resulted in a series oif steps lower which culminated in a low at $596.00 late in the afternoon. There was naturally some defence of positions which pulled prices away from the lows heading onto the call with settlement for May’23 made at $597.80. The take on the day is likely to be driven by an individuals own book, as while disappointing on the surface the market still stands in a healthy position should more meaningful buyers be found at these higher levels.