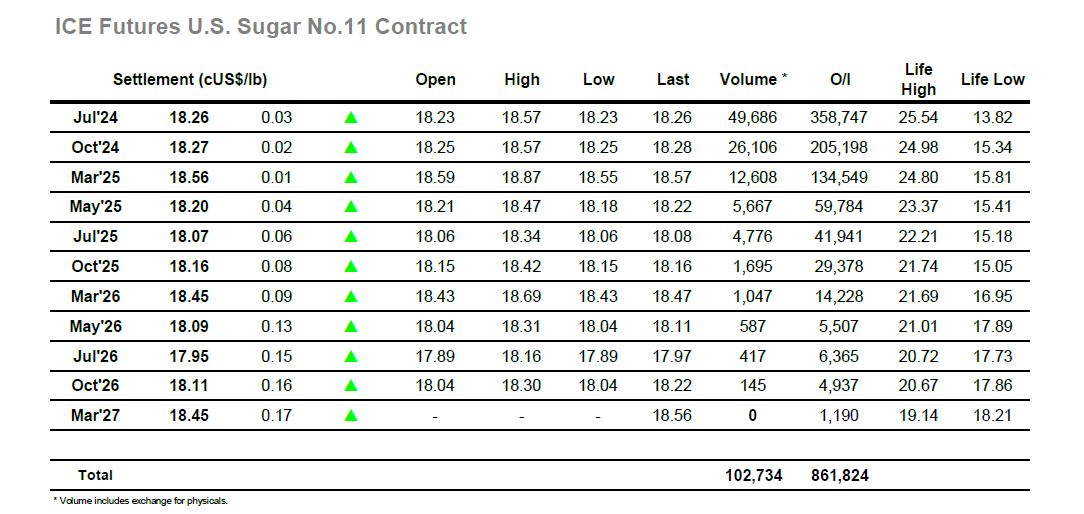

Having fallen back through the range over recent sessions the market once more turned following today’s opening as buyers returned to bid Jul’24 quickly upwards to 18.52. Sadly, for those looking for fresh impetus this market the end of the move and for the rest of the morning the price activity held to the 18.50’s/18.40’s on low volume, returning to the parameters seen earlier this week. The situation has reached something of a stalemate, and though the early afternoon saw fresh efforts to re-engage upside movement from small traders the market failed to extend beyond 18.57, confining the situation to another day of tedious stagnation. There was a decline through the afternoon which saw Jul’23 back to 18.23, though this was still above yesterdays lows and so maintained the markets path towards an inside day. The final part of the session played out just ahead of the lows, leading Jul’24 to close at 18.26, minimal change to end another slow session with the wider parameters unmoved.

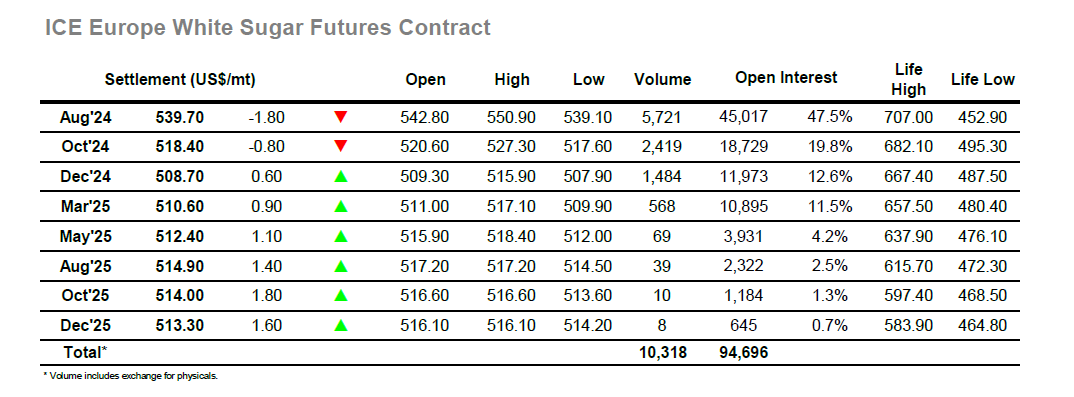

Aug’24 jumped back up on today’s opening, reversing some of this week’s losses and sending Aug’24 back up through the $540’s. By mid-morning, the market had reached to $549.60, though progress then stalled with the all too familiar constraints keeping the market to existing parameters. There was little change to the picture over the next few hours, a small extension to $550.90 widening the days range but sitting well short of this weeks $555.00 high mark. Working through the afternoon this latest failure to rally drew another bout of spec/small trader selling, its impact proving significant at the top of the board with Aug’24 and Oct’24 trading down to new daily lows as we reached the final hour. The pressure maintained through the latter stages, and further new lows were recorded at $539.10 on the post close following the establishment of settlement at $539.70. Aug/Oct’24 was slightly lower at $21.30 though remains relatively robust, while the Aug/Jul’24 white premium was weaker at $137.00.