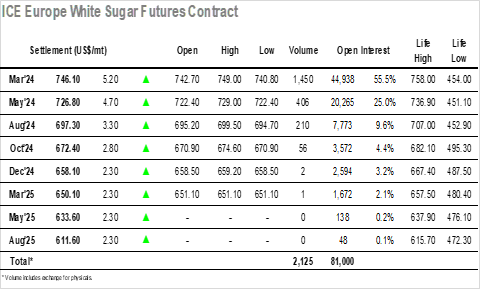

The market began the day quietly though some light buying was emerging in light of yesterday’s decline which held March’24 in credit through the early morning. With many traders away from their desks due to the US holiday volume was far lighter than usual, and with the sell side particularly thin it seemed that some longs were taking the opportunity to begin pushing higher again with prices back to the mid $740’s reaching noon. This drew fresh interest behind and a spike to $749.00 followed, more than $8 higher, though historically the kind of gain that is unlikely to be matched by No.11 when it resumes tomorrow. The longs endeavoured to maintain some strength through the afternoon and though values ultimately fell back into the range there were still gains of more than $5 recorded at the conclusion of trading with settlement made at $746.10. With volume only just tipping above 2,000 lots the move today was not sufficient to be considered significant, however it will pose an interesting dilemma for buyers when No.11 resumes.

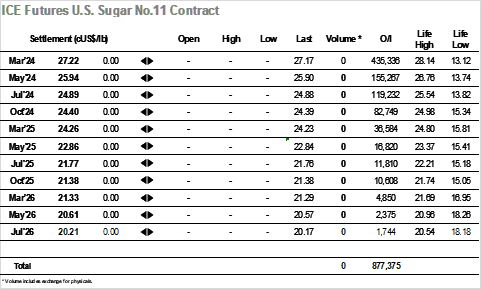

Sugar No. 11 market is closed today due to Thanksgiving Holiday