A higher call was followed with March’24 commencing the day at 22.00, and following a brief dip back to 21.85 the price action then looked to push ahead. Volume was far outstripping recent efforts as traders reacted to a tweet regarding lower Brazilian stock levels, and the movement fuelled by spec and trade buying extended the gains to 22.39 (+66) with little more than an hour having elapsed. The mood was clearly positive and so the market was able to consolidate near to the highs as day traders looked to maintain the strength in the hope of additional gains, and following some prolonged consolidation the market started to look higher during the early afternoon hoping to draw in US interest to continue the move. Having recorded a new high at 22.43 it became apparent that there was not the interest that small traders had pinned hopes upon and retreat to again sit in the 22.20’s followed. As sideways trading resumed some nervous longs headed for the exit and triggered a brief downward move, though prices gathered themselves and the generally positive consolidation resumed. Spreads were buoyed through the flat price support which led March/May’25 to 1.78 points intra-day and May/Jul’25 to 0.99 points, though both dropped back a little from these marks during the afternoon. Market kept trading sideways until daily close at 22.35. Settlement price was 22.34, a 61-point move against last settlement. March/May’25 softened a bit settling at 1.73. Volume traded was 56k lots.

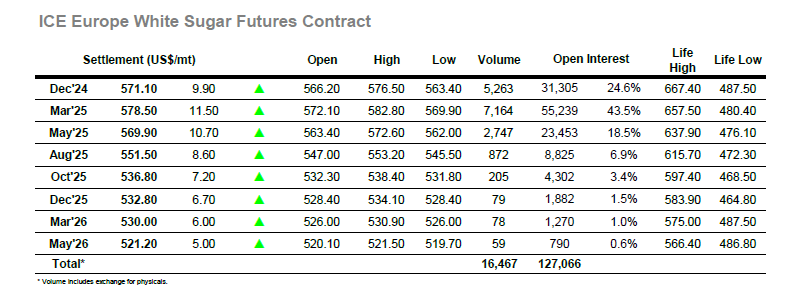

A wild opening saw Dec’24 trading between $563.40 and $570.50 across the first few minutes as prices reacted to the firm start in the No.11, and following a period of consolidation the market looked to continue pushing upward. Dec’24 extended to $574.40 before pausing, and the mood remained far more positive than in recent days as the rest of the morning played out to the upper end of the range to keep the bulls interested. With so many longs holding on to positions it was not surprising that the early afternoon period saw another push upward which reached $576.50, though the obvious motive of attracting US spec/fund buying to bolster the move was unsuccessful and the price action soon returned to the lower $570’s and the band which had prevailed through the morning. Outright volumes dropped away during the afternoon as the price continued sideways with a small loss of power closing at $571.30. Settlement price was 571.10, a $9.9 increase against last settlement. Volume traded was 5k lots.