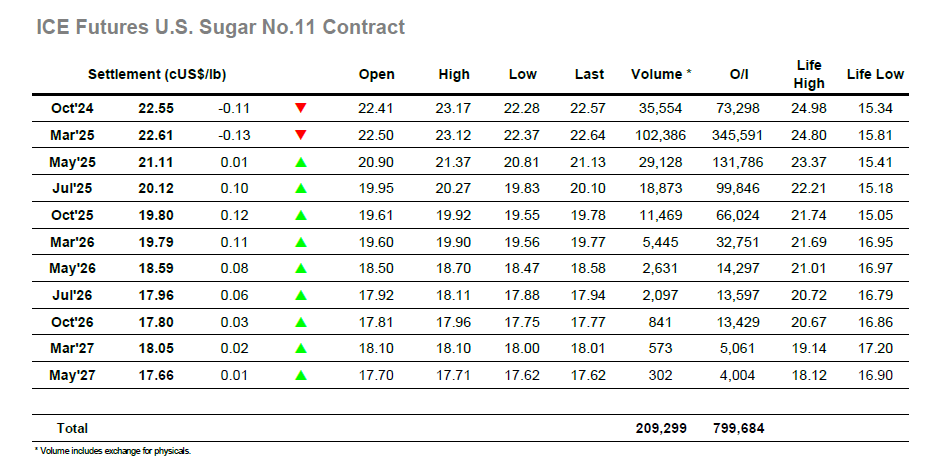

There was market volatility from the off this morning as March’25 ranged between 22.40 / 22.96 across the first 20 minutes, however unlike recent session a period of calm followed behind and prices established a trading band either side of 22.70. Fridays COT report showed that the speculative sector had moved back to a small net long of 2,571 lots as at last Tuesdays close, however this number is significantly different to the live position with the high-volume movements which has seen the price rally by more than 200 points in the intervening sessions sure to have added tens of thousands more to the long position. As such a period of calm to reassess the position was probably wanted by many and the rest of the morning passed calmly with traders awaiting the US day to see whether that generated some new movement. The US specs obliged with some more buying which took March’25 through 22.92 and on to another recent high at 23.12, but unlike last week there was not the depth of continuation interest and when the move topped out, we saw smaller traders quickly running for the exit. Oct’24 meanwhile continued its path toward expiry with ongoing spread volatility as morning buying saw Oct’24/March’25 rally to 0.11 points premium before returning to a discount during the afternoon. Having fallen back from the highs we saw the market wobble during the final hour before being picked up to limit losses and close at 22.61 for March’25. This was the first hint of fatigue on this recent move and provides a warning for bulls that should the buying fade then there is potential to slip quickly away from current levels in the short term, maybe tomorrow will provide more clarity as to their appetite / capacity to continue pushing.

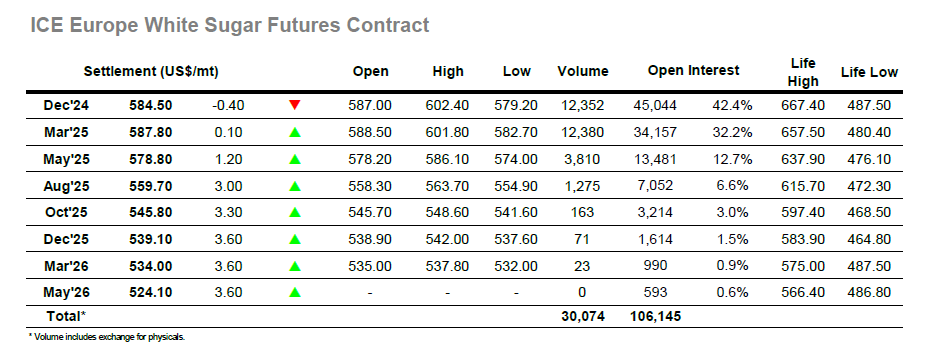

There was a push to $593.40 as we opened however with initial hedging concluded the market soon set back towards unchanged levels. As things calmed a sideways pattern established in the upper $580’s and following the volatility of last week it felt that there was a contentment amongst traders to let things calm down and take stock of the situation. This status quo maintained through into early afternoon with no apparent desire to push the market in either direction until from nowhere the market exploded against a short, sharp burst of buying. This sent Dec’24 spiking to $602.40, though the highs were seen only briefly and across the next hour the market returned to where it had come from to resume the sideways pattern. Though lacking any extended flat price movement there was still a good volume changing hands as growers continued to take advantage of higher levels, with outright volume outstripping the spread activity on the day as Dec’24/March’25 held near to -$3.00. There was some movement away from the band during the final hour and on this occasion the market worked lower as some light liquidation / profit taking occurred against recently established longs, maybe feeling that the spike above $600 represents a near term top. From a low at $579.20 the market was bid back up on the close to minimise the daily loss and settle Dec’24 at $584.50. Overall, this left a neutral close which changes little in the wider picture, though the short-term moves appear unclear with $600 remaining an upside target but conversely with any weakness likely to bring the downside gap to $572.00 into focus.