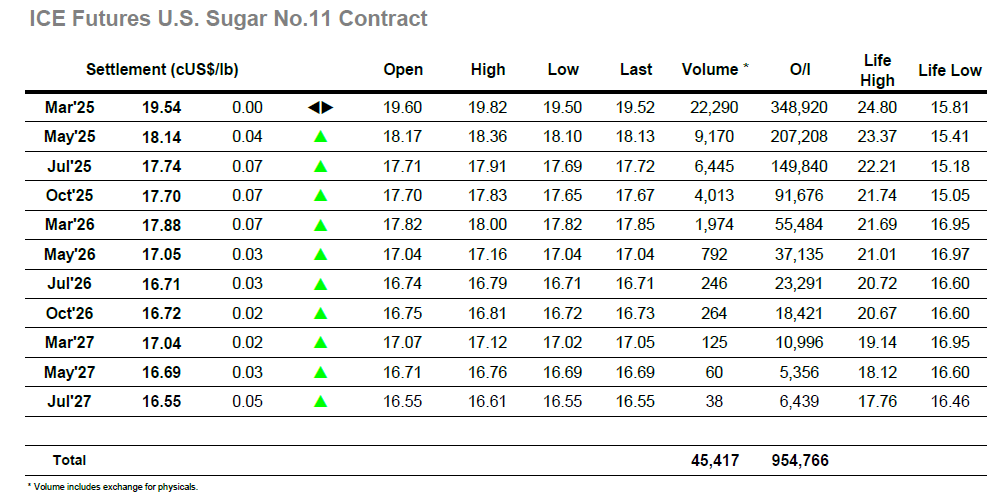

There generally more positive mood of yesterday was continuing as the market saw a higher opening period, and despite then slipping back to overnight levels the market soon regathered and began to trend higher. Through the morning the priced forged ahead to trade just beyond yesterday’s mark and reach 19.82, although the rally then came to an abrupt halt with day trader liquidation gathering on the retreat and sending the price quickly back through the range. See-saw action continued through noon with the thin pre-Christmas environment allowing for small and meaningless swings in price, but as we moved into the afternoon the pattern of trading contracted, and a tighter range established. With the London whites already closed there was not even some sporadic white premium volume to aid an already slow market which left March’25 to pad its way through the afternoon in the 19.60’s on such low volume which made it clear that all but the hardiest of traders had already left for the holidays. The only change to this picture came during the final hour as light selling / liquidation sent March’25 slipping back to an unchanged close at 19.54 and send the market into Christmas day in the quietest of ways. Trading resumes with a delayed opening on Thursday (7:30am US / 12:30pm UK) and in the meantime we wish all our readers a very happy Christmas holiday.

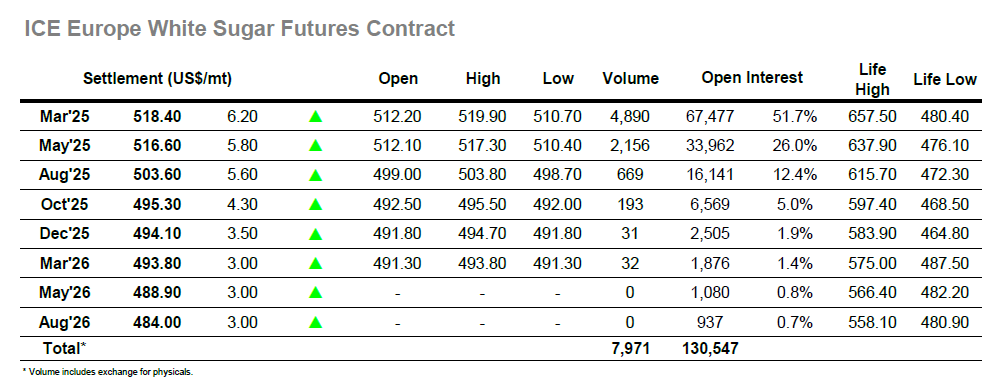

Early buying enabled March’25 to pop up to $515.00 and though the price briefly came back beneath overnight levels a more concerted effort to rally began soon afterwards. By the middle of the morning the market had accumulated at a steady pace to record a high at $519.90, impressive movement given the limited volume on show, although with the early close not too far away there was some position liquidation soon afterwards to erode a chunk of the gain and send the price back to the lower teens. The price accumulation had led to increase in the 2025 white premium values with March/March’25 seeing highs in the $83 region and May/May’25 touching at $113.00, and these were largely maintained even with the correction into the range. There was a resurgence in the price around noon as buying re-emerged ahead of the close and led March’25 to finish several dollars firmer at $518.40. Closing values for the white premium remained around $83.00 for March/March’25 and $113.00 for May/May’25 heading into the two-and-a-half-day hiatus for the Christmas holidays.