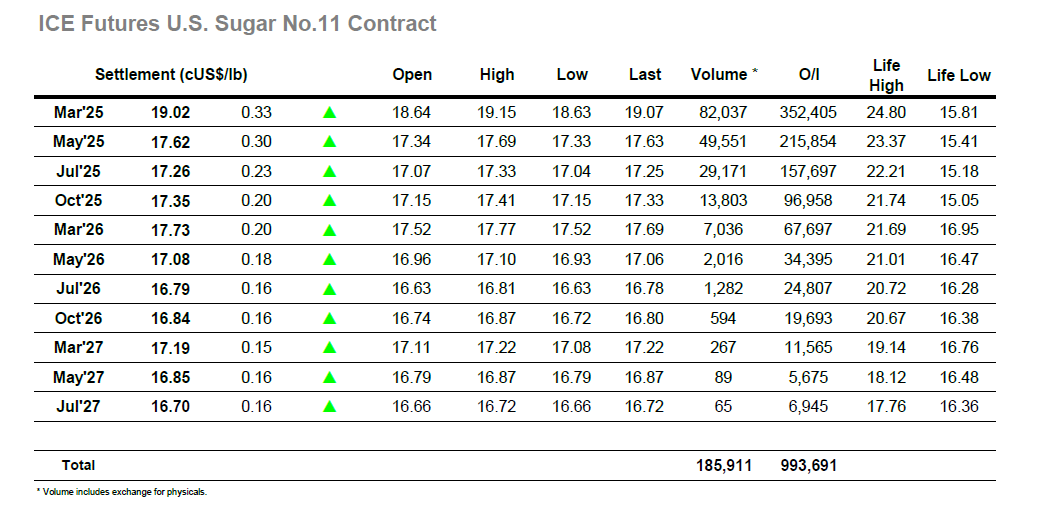

Initial trades down to 18.63 were very brief as the market quickly surged ahead again to maintain the recovery of the past two sessions. There was not much resting selling on show during the early stages and this allowed March’25 to accelerate towards 19.00 on moderate volume, with pricing only picking up in the upper 18.90’s to provide resistance which halted progress for a couple of hours. The buyers were in determined mood and so further pushes followed later in the morning and as we moved into the afternoon which resulted in new highs at 19.14, with both trade and spec buyers again being identified across the 2025 positions. More remarkable than the flat price rally was the March/May’25 spread movement where the price was being pumped up significantly to a high at 1.52 points, its highest value since mid-December and far outstripping the outright recovery in relative terms. Moving through the afternoon the market was calmer and entered a consolidation pattern either side of 19.00, with assorted grower pricing meeting the buyers and neutralize the picture. There was a push from longs to take the market higher still which saw marginal new highs at 19.15, but that was as far as their efforts merited before pre-weekend position squaring kicked in. Still the March’25 was able to settle at 19.02 to conclude another solid showing, while March/May’25 ended away from its highs at 1.40 points after some opportunistic rolling through the afternoon. Tonights COT will be particularly outdated as it will not reflect the 3-day rally, and with the trade onside over the second half of this week maybe there are more gains to follow in the short term.

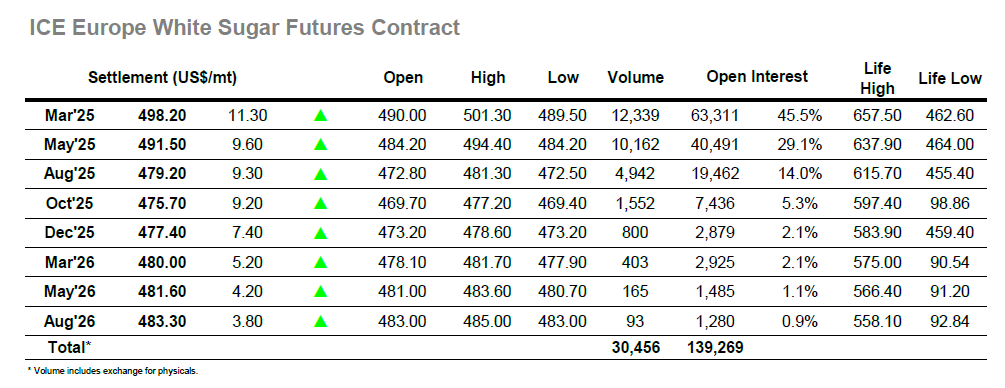

The resurgence continued with another strong opening seeing March’25 rise to $494.60 across the first twenty minutes of trading and then continue ahead more steadily as the morning progressed. Buying was coming from all areas (outright, spread, and white premium) as a morning high was recorded at $499.20, with another push just as we moved into the afternoon seeing the market trade at exactly $500.00 to satisfy those buyers who had been pushing for the psychological mark. There was a slight cooling as the afternoon progressed with the market tickling along a few dollars shy of the highs, but the sentiment has turned for the time being and so there were no real efforts to destabilise the recovery. This laid the foundation to make another effort at $500.00 later in the afternoon and on this occasion the March’25 contract moved through to $501.30 before again cooling off slightly ahead of the close. As referenced, there were further gains made for the March’25 spreads with daily highs seen at $7.50 for March/May’25 and $20.60 for March/Aug’25, while for the white premium March/March’25 spent most of the afternoon in the $79 area having been trading around $74 when we opened this morning. March’25 settled at $498.20 to bring the week to a steady conclusion, presenting a very different picture to the last few weeks as traders head into a well-earned weekend.