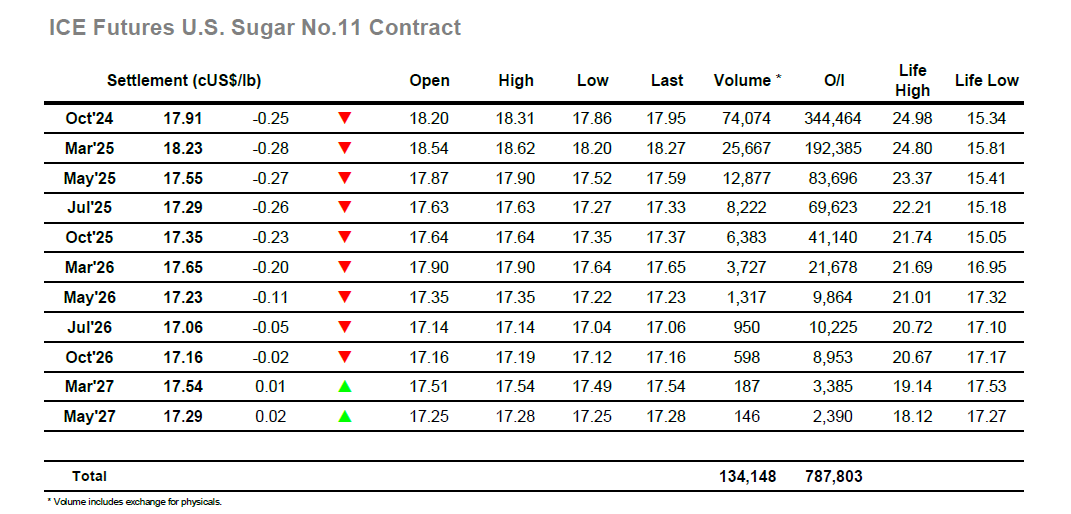

There was some moderate buying in place for the market this morning as physical pricing combined with some technical support, with traders prepared to take a chance of buying in front of both Oct’24 and continuation lows wither side of 18.00. This enabled the price to work up to late morning highs at 18.31, a modest gain but one of the better efforts seen across what has proved to be a very poor month. The arrival of those in the Americas signalled for prices to ease away from the highs, and the closer that Oct’24 moved to the support area the more we saw pressure being applied by the spec sector. Keen to maximise opportunity there was a burst of selling which pushed beneath 18.00, with almost 9,500 lots trading in a 5-minute period as the price moved beneath 17.95 to be at the lowest front month levels since April 2022. While there was no recovery made from this fall the market did at least dig in to hold near to 17.90 throughout the final couple of hours, sitting atop the new recent low of 17.86. Reaching the close we made settlement at 17.91, another poor number from a technical standpoint leaving no indication yet as to where a bottom may be found.

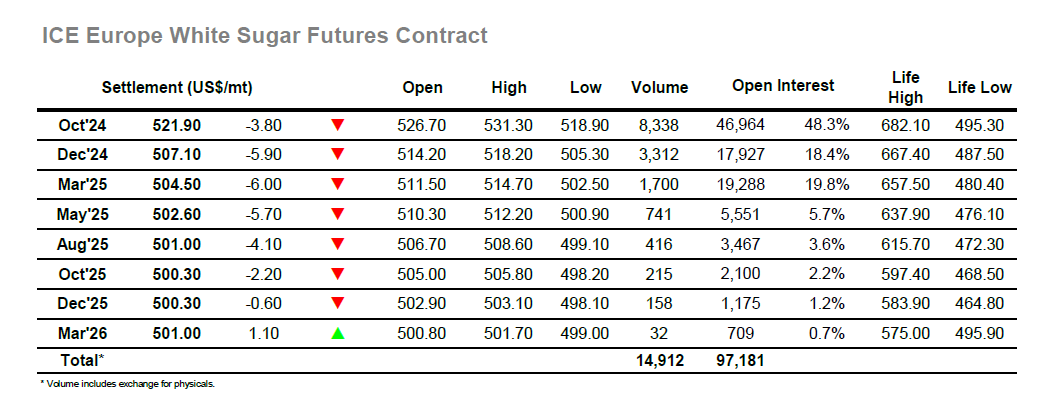

Starting the day either side of unchanged the market soon moved back higher with Oct’24 printing up to $529.20 before pausing, there were further gains to follow as the morning progressed and Oct’24 extended to $531.30 before noon, providing the rare recent image of a positive board. Early afternoon saw the momentum gradually being lost with the gains slowly eroding against reduced buying, and it seemed for a period that the market would settle into a pattern of slow consolidation, however fuelled by No.11 activity this was not to be the case. Additional spec selling drove values back into deficit midway through the afternoon and while the market price remains many dollars above the May’24 lows and technical support there remain few willing to step in and defend against the tide. Only having fallen to $518.90 did the market pause against short covering, scant consolation for those that remain long with no sign that the market is yet ready to mount a recovery. White premiums had shown some resilience during the morning and strengthened on the rally, however by the final hour Oct/Oct’24 had fallen back beneath $126 once more. There was a degree of position squaring late in the session which led to a close at $521.90, another daily loss which sees the wider picture remain negative.