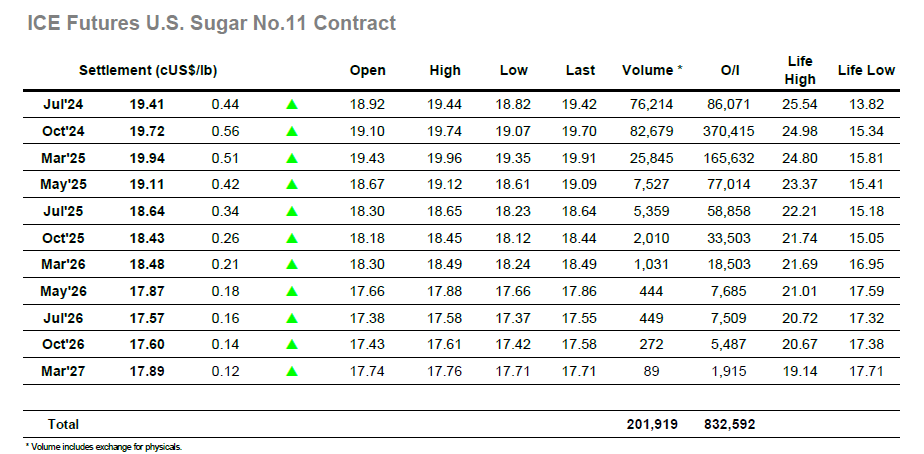

The new week saw some calm trading to get things underway with Oct’24 dipping back to 19.07 in amongst an otherwise solid morning though not pushing beyond the 19.20’s. The recent weakness for the Jul/Oct’24 spread has anchored prices into the range, but with volumes reduced during the final week of Jul’24 trading this seemed to be less of a hinderance and Oct’24 started to work higher again. Scale selling from growers remains down the board but it was having little effect as buying from specs and algos chipped away to take Oct’24 up to 19.73 over the following few hours, There was no hint of reversal from said buyers (and in reality some of the buying will have been short covering) and so the final two hours simply showed as sideways consolidation, attempting to tee the picture up for a look at the 19.98 early May high. This left the market able to cement a settlement at 19.72, just two points shy of the highs and looking to continue. Tonight’s delayed COT report is not anticipated to throw up any surprises with a limited change on the spec position expected, and so it seems likely that the move attempts to continue when we resume.

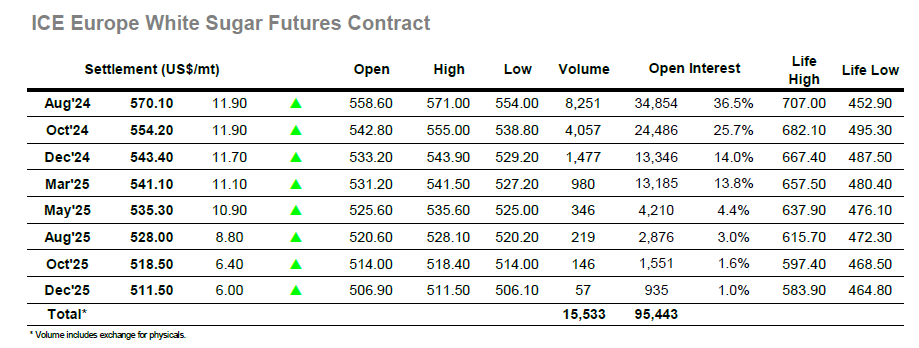

· It was an inauspicious start to today’s session as Aug’24 reversed initial gains and traded back to $554.00, before looking to edge back towards unchanged levels. These were only reached around noon but having moved back into credit it did not take long until some more substantial buying arrived with the prospect of pushing back towards recent highs back in play. With the initial push reaching $561.80 additional enthusiasm was generated and over the following two hours the price increased steadily to be only just below the $568.00 mark from 13th June. This movement was rippling into the white’s premiums also with Aug/Jul’24 back into the low $140’s, though the fall for No.11 spreads was also playing its part in the increased valuation. The pace of increase slowed during the later afternoon, but that did not faze the buyers who were content to consolidate the gains with the market now at its highest price since 13th May. Having remained comfortably in the $568.00/$569.00 area for two and a half hours the longs lined up one more late push and extended the highs to $571.00 during the final minutes. Settlement was made at $570.10 to provide a positive technical close, and maybe the market can now look to challenge the highs from early May.