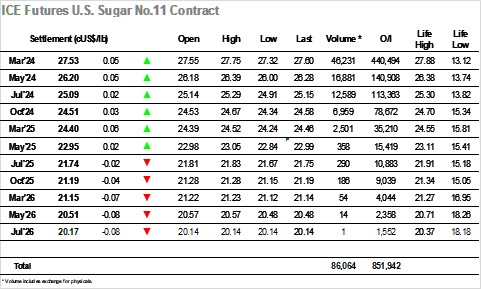

Today, number 11 displayed sideways movement throughout the day. After opening at 27.55, the market showed strength with a strong buying movement, rising 10 cents to 27.65 before being interrupted by a weakening of positions. Prices regained some strength, maintaining the level of 27.60 for about 2 hours until a strong buying position pushed number 11 to its daily high of 27.75, followed by a weakening of positions and low trading volume, opening at the daily low of 27.32. The market continued to exhibit sideways behavior until closing at 27.60. Settlement price was 27.53, + 5 points above Monday’s settlement, and H4K4 spread closed at 1.33, net.

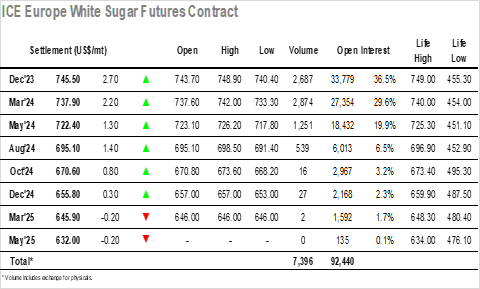

.Today, white sugar no.5 displayed sideways movement throughout the day. Prices opened at $743.70, followed by strength with a strong buying movement, rising to $746 level before being interrupted by a weakening of positions. Prices regained strength, regaining the level of $746 until a strong buying position pushed no.5 to its daily high of $748.90, followed by a weakening of positions and low trading volume, opening at the daily low of $740.40. The market continued to exhibit sideways behavior until closing at $746.10. Settlement price was $745.50, + $2.70 above Monday’s settlement.