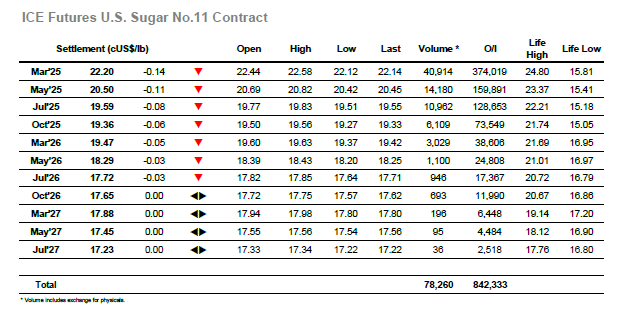

Opening highs at 22.49 were not sustained, however the trade led push from yesterday remains fresh in the mind and across the first two hours we saw buying interest resume to rally March’25 up beyond this market to 22.58. There remains a momentum issue with many traders still reluctant to get involved against the current rangebound picture, and this hindered progress once again as the later morning / early afternoon saw prices drop back down into the range. Day traders were shoeing some involvement with some downside pressure during the afternoon though these efforts too failed to generate any great momentum, and it seems that despite the bullish input from yesterday the wider consensus of “stagnation” still prevails. March’25 did work down through the teens later in the day to register session lows at 22.12, but despite the lacklustre showing there was no indication that this would lead prices back to a 21c handle. Instead, the later stages played out sideways ahead of the lows, with March’25 settlement arriving at 22.20 and March/May’25 at 1.70 points, minor losses which leave the big picture unchanged.

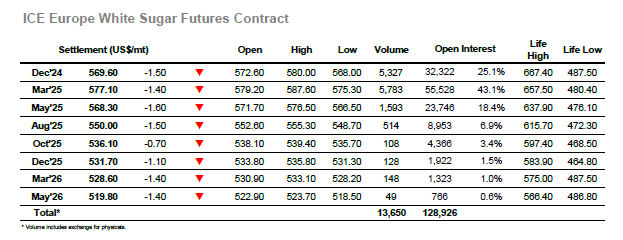

Mild early gains soon increased as the positive vibe from yesterday was maintained leading Dec’24 to climb up through the $570’s. A mid-morning high was recorded at exactly $580.00 before consolidation set in, and while the price remained to the upper end of the range it was on painfully low volumes. The early afternoon drew a little more selling into the environment which further reduced the early gains, though overall it was so quiet that it meant little. There was some steady spread volume changing hands for both Dec’24/March’25 and March/May’25 though movements were limited for both as buyers and sellers matched off, but otherwise it was a case of the recent apathy stretching out for another day. Buyers had lost enthusiasm through the afternoon and so as small traders squared positions out there was an additional decline which placed values into the red with a couple of hours remaining and placed values into the upper $560’s. The market remained at the bottom of the range through the final couple, of hours ahead of a Dec’24 settlement at $569.70, concluding yet another slow day with the market no closer to finding a route out of its current band.