The move to a 17c handle yesterday inspired additional physical activity / pricing and saw the Oct’24 price jump back up to 18.18 during the first 15 minutes of trading against around 4,000 lots. Selling was understandably limited at these levels and the market was then able to consolidate the gains, centring around 18.15 throughout the morning on lower volumes. Moving into the early afternoon the market nudged to marginal new highs, a situation which accelerated soon afterwards with the start of the US morning. Oct’24 rose sharply to 18.60 before encountering some profit taking, though the picture remained steady with the price then holding the 18.40’s. Speculation was that the rally was being driven by expectation of poorer than anticipated UNICA figures for the first half of July, and so eyes were firmly fixed upon the 3pm announcement. The news broke showing Cane at 43.170 mmt / Sugar 2.939 mmt / Mix 49.88% / ATR 143.27 kg/t / Ethanol 2.126 mlt, providing confirmation that the numbers were indeed below the consensus of estimates. The market reacted with another small push to new highs at 18.70, maintaining the sharp turnaround in recent fortunes but aided by an absence of overhead grower pricing. The later part of the afternoon was spent holding near to 18.60 as the market conveyed the most confidence seen in a while, and with some fresh buying emerging ahead of the close this ensured an Oct’24 settlement level of 18.66. The question now is whether this will mark the lows for the time being? How we react tomorrow should provide some clues.

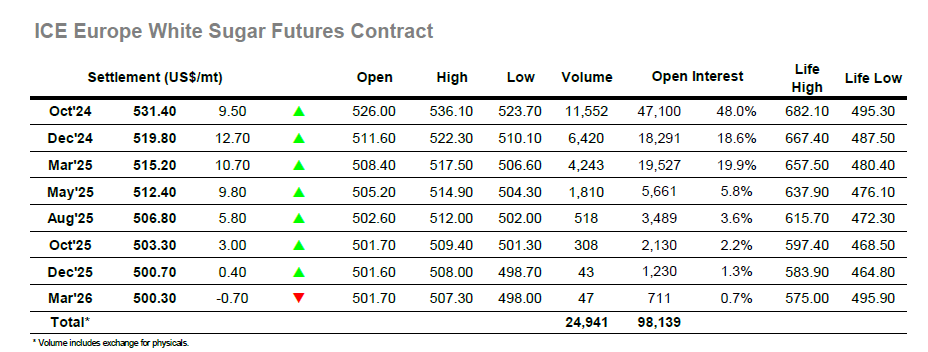

There was a jump higher for Oct’24 on today’s opening as buying emerged, and in mixed early trading the price pushed ahead to $529.10 before looking to consolidate. The market achieved this comfortably through the morning despite a dip to $523.70 as it looked to fill the intra-day chart gap, with the small swings causing small movements for the white premium but having no other impact. Moving into the early afternoon the situation change, and unusually it was the upside being investigated with the US specs driving both sugar markets ahead in advance of the latest UNICA data release. The data proved to show lower than estimated production and so signalled a further push to highs at $536.10, though progress then began to stall with few buyers willing to continue paying up, no doubt scarred by recent experience. While the gains were solid, the whites were failing to maintain the pace of No.11 through the afternoon and so the Oct/OIct’24 arbitrage narrowed back towards $122.00, though this was maybe not surprising given how its recovery over recent weeks was aided by the whites having shown more resilience than No.11 when sliding. Having fallen back from the highs we saw the final 90 minutes spent holding the lower $530’s, maintaining a good chunk of the gains though with the front month not quite showing the double digit gains that Dec’24 and March’25 managed. This left the Oct/Dec’24 spread ending the day in at $11.60 while Oct/Oct’24 was on its lows at $120.00 despite an Oct’24 settlement value of $531.40.