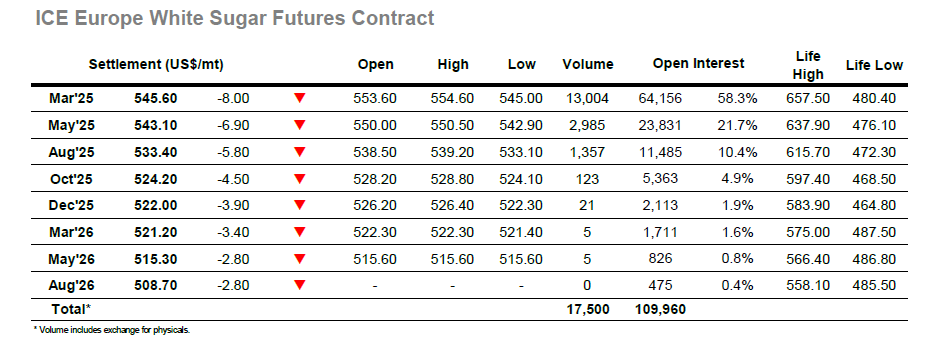

Pre-opening was indicating a higher call, and March’25 obliged with opening prints at 21.40 before slipping down to hold the upper 21.20’s through the early part of the day. A mid-morning push to 21.43 failed to gather any continuation buying leaving the market to fall back to the 21.20’s and in turn another couple of hours of sideways stagnation. For many weeks, the greatest driver of intra-day movement has been the smaller specs, however even they have reduced exposure of late and this week’s COT report showing a new spec position at just -272 lots emphasises the lack of enthusiasm from this sector. With this in mind it was proving tricky to generate much movement for either direction and while an afternoon dip into the teens widened the range it was taking place against low volume. For the spreads it was only March/May’25 which showed any noteworthy volume with the value falling back again from its previous heights to stand at 1.26 points. Day by day we have seen the market bring the recent 20.86 low back into view and the later afternoon garnered some additional small trader selling as they looked to generate a more aggressive dip, but their selling lacked the necessary size to even test to 21c with a low at 21.11 holding through the final hour. Settlement was a small way above this at 21.15, leaving the lower end still in view when we resume.

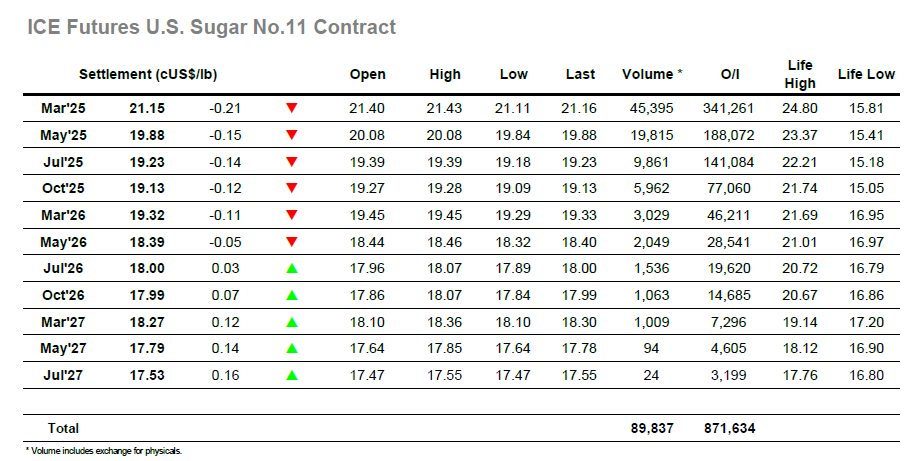

Starting the new week at unchanged the market soon began to track lower again, although light buying in the $550.00 area proved sufficient to hold values across the first few hours, such was the lack of outright volume being traded. Moving through into the afternoon there was some slight widening of the range but little other excitement with another day of sideways drift seeming the safe option for all while news remains lacking. With the flat price trading lower there was always likely to be some focus on the underlying support levels from day traders and a slide beneath $549.20 later in the afternoon drew in a little more selling pressure which sent the price down within $3 of this month’s low late in the day. Our market was faring worse than No.11 which impacted the white premium value, March/March’25 moving back to the lower end of its range also by trading to $79.00. There was no closing recovery with settlement made just o.60c above the low at $545.60, bringing aa quiet day to a conclusion with the $542.10 support mark firmly in view.