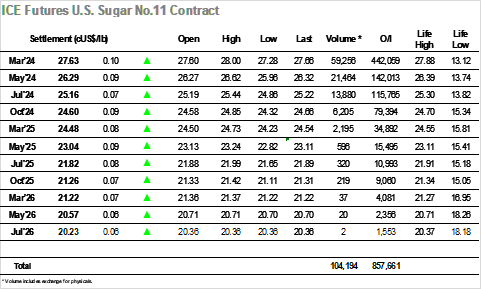

Today, No.11 opened at the same level as yesterday’s settlement. In the first half-hour of trading, the market experienced an upward movement, reaching the 26.70 level. Over the next four hours, the market gradually continued to rise, reaching its peak at 28.00 around 1:00 pm, driven by strong buyer positions. However, that level wasn’t sustainable, and in the afternoon, the market exhibited a downward trend until 3:00 pm, stabilizing at the 27.50 level. Prices faced a rapid downward movement near the end of the session, reaching a minimum of 27.28 due to a strong selling movement, followed by a recovery to the 27.50 level when encountering a sudden buyer position. This led prices to close near yesterday’s settlement at 27.66. The settlement price was 27.63, which was 10 points higher than yesterday’s settlement. The volume traded amounted to 59k lots, and the H4K4 spread closed at 1.34, an increase of 0.01.

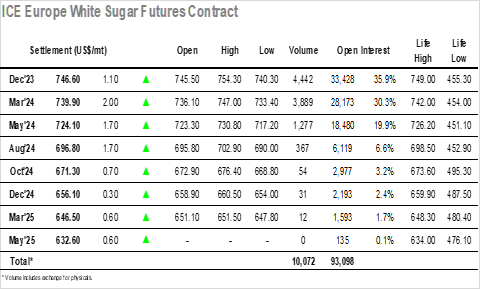

Today, No.5 white sugar opened slightly below yesterday’s settlement. In the first 15 minutes of trading, the market experienced a strong upward movement, reaching the $750 level and holding that position over the next four hours. Around 1:00 pm, No.5 reached its peak at $754.3, driven by strong buyer positions. However, that level wasn’t sustainable, and in the afternoon, the market exhibited a downward trend until 3:00 pm, stabilizing at the $744 level. Prices then experienced an upward movement near 4:00 pm, reaching $746, followed by a downward movement that led prices to their lowest point at $740.3. Near the end of the trading session, the market saw a recovery to the $746 level when encountering a sudden influx of buyers. This led prices to close above yesterday’s settlement at $747.3. The settlement price was $760.6, an increase of $1.1.