Opening either side of unchanged the market was soon under some pressure with selling emerging to send the price back down towards 22.00 and look beneath yesterday’s lows. The price touched 21.96 against additional selling before popping back up into the teens, and this seemed to set the pattern for the next few hours with activity taking place within the same range. A small push to new lows at 21.92 marked a livelier period as traders then swung in and out of the market in pushing the price up to 22.32 before sending it back to 22.00 as the UNICA numbers for the first half of October we published. These showed cane 33.832 mmt / Sugar 2.443 mmt / Mix 47.28% / ATR 160.30 kg/t / Ethanol 2.007 mlt, marginally better than expectation but not by enough to matter, and so the market simply returned to sideways trading. This prevailed for the duration of the session to bring another mostly tedious day to a close, sending March;25 into the weekend just 6 points lower at 22.14 and with the market no closer to finding its next significant movement.

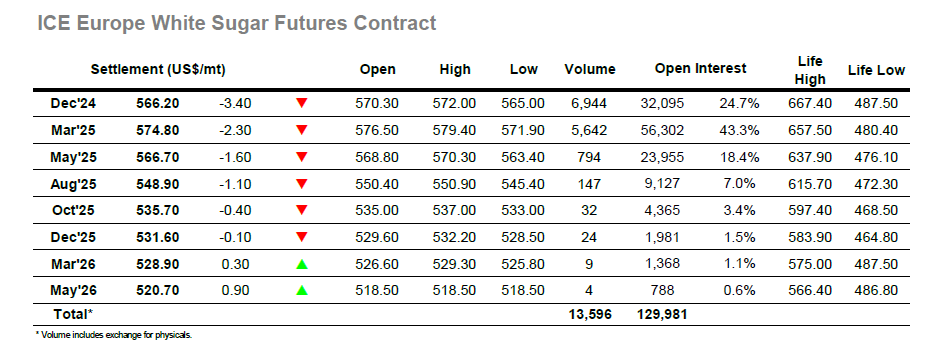

Having failed to build upon Wednesday’s positive efforts the market has returned to the range, and an inauspicious start to trading today which saw Dec’24 dipping back down into the upper $560’s suggested that this would likely continue. The lower values were reversed with a short but sharp push back to $570.20 ahead of noon, but the movements were purely being generated by the small trades/specs and so as the buying eased so the price slipped back again. Movements remained quite volatile into the afternoon with the market rallying from the lows to a daily high at $572.00 before a similarly rapid decline wiped out the move in an instant. These actions widened the range a little further but changed nothing in the context of a rangebound market, with the scale of the moves saying more about the illiquidity of the flat price than anything else. There was more sizable volume for the Dec’24/March’25 as rolling ramps up ahead of the Dec’24 expiry next month, with this spread alone making up around 50% of the total daily volume for the market as the value fell to a lowest -$8.80 late on. White premiums softened slightly with March/March’25 heading into the weekend at , though volumes here were low. Dec’24 closed at $566.20 to head quietly into the weekend.