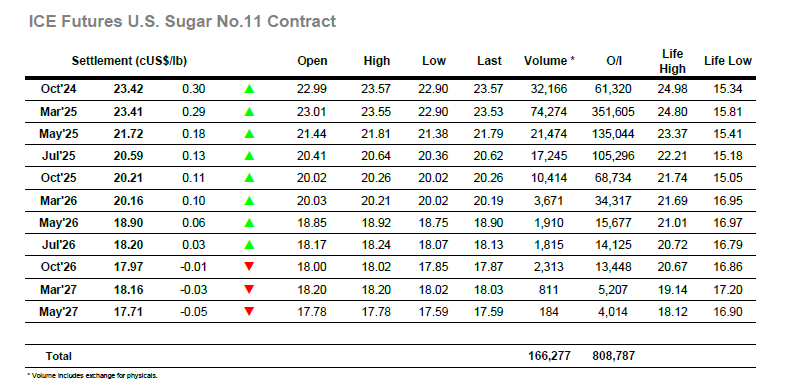

Having settled positively last night the market was quickly rocking higher once more as the early stages saw prices push to yet another new recent high and extend the March’25 price to 23.48 before pausing. Having consolidated for a while the lack of continuation buying encouraged day traders to close out some longs and send the price back to unchanged at the end of the morning. There was a bit of a wobble as the US morning commenced with a dip to 22.90 against some additional light liquidation, however the sentiment remains positive and when this move was gathered up prices were quickly pushed back in the direction of the highs. From mid-afternoon activity levels dropped and the price settled down to a narrower band, with the longs again happy to hold on to another steady gain and allow their position to further improve on minimal exertion. The status quo maintained until the close when some late buying arrived to dress the settlement, and while it only succeeded is closing March’25 at 23.41 the continuation into the post close saw new highs at 23.55 which may well set the tone for continuation tomorrow. Oct’24 continued its move towards expiry calmly with the spread showing smaller movement today, Oct’24/March’25 ending at a 0.01-point premium. Open interest dropped back 61,320 lots, and as things stand it seems there will be an orderly reduction of this number ahead of Monday.

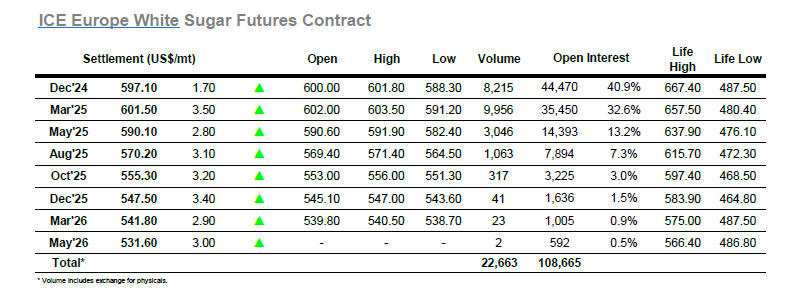

A jump to $601.80 for Dec’24 on the opening came up just shy of Monday’s highs, and this seemed to deter additional buying as the price gradually eased back down to unchanged levels over the next couple of hours. While there was no hint of any significant decline, the early failure to break new ground had certainly dented confidence with nearby values falling back in the middle of the session and a Dec’24 low registered at $588.30. A quick recovery followed to bring values back into credit however it was clear that enthusiasm had waned with the white premium losing ground as we failed to keep pace with No.11. March/March’25 traded back down to $84.00 and remained in that area through to late afternoon, while nearby spreads also wobbled as Dec’24/March’25 slipped back to -$4.70. It proved to be a calmer period of trading through the rest of the afternoon as prices held sideways, only enlivened into the close as some late buying arrived in conjunction with No.11 to dress the settlement. This left Dec’24 closing at $597.10 to show a mild gain, though should it continue to sit below Mondays $602.40 mark some nerves may begin to jangle.