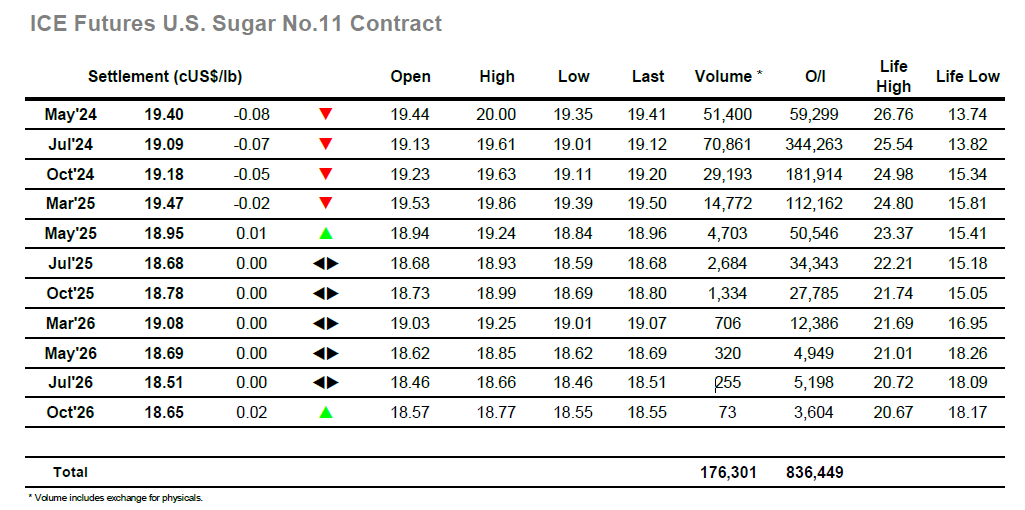

Jul’24 held above 19c on today’s opening and soon was gathering buying to work back up through the range once more. The upwards trajectory extended throughout the morning and on low volumes the market was able to reach up to 19.61 ahead of the US morning. This placed the market in a better place, however with much of the support having emanated from day traders the progress stalled, leading to a period of consolidation. With little other news there was some anticipation around the UNICA release from the first half of April, with the publication showing 15.81 mmt cane / 710,000 mt sugar / 43.64 % mix / 107.93 ATR. This was above estimates, and there was clearly expectation of this with Jul’24 commencing a sharp decline ahead of the release and continuing to 19.02 as frantic long liquidation occurred. A similarly quick recovery to 19.40 followed, however this proved to be a blip and with the damage already done the market tracked back down towards the lows during the final hour. Alongside the see-sawing market price the May/Jul’24 spread held onto recent gains with trades out to 0.40 points before slipping back to 0.31 points late in the session. The close played out just ahead of 19.01 lows, with settlement reached at 19.09 to send us into the weekend with recent lows still in range.

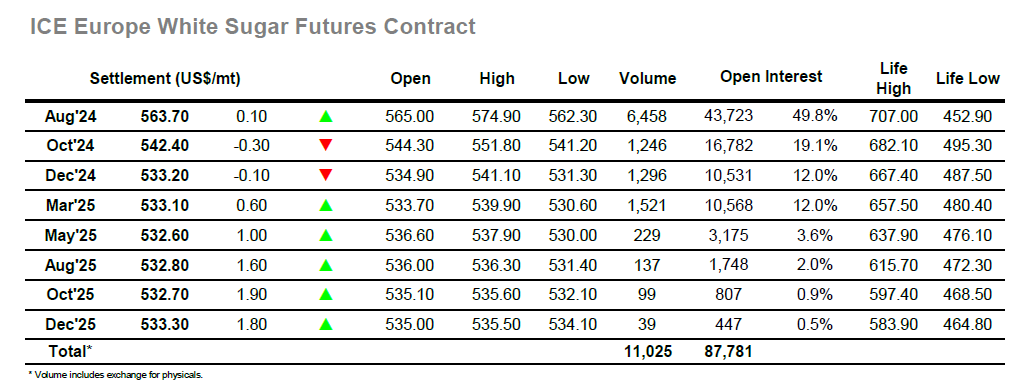

The market built steadily throughout the morning to regain some lost ground, the movement taking place quite easily due to a lack of resting selling and extending the Aug’24 price to $574.90 just after noon. Lack of news and any resultant impetus continues to restrict involvement from certain sectors, and this became obvious as prices settled back into consolidation pattern during the early afternoon with only the spot seeing any volume of note. The picture changed dramatically during the early afternoon as selling around the UNICA crop announcement in Brazil sent No.11 tumbling, with the whites following suit to suddenly be making marginal session lows. There was a bounce as day traders scrambled around, though by the final hour prices were back under pressure again with Aug’24 seeing session lows at $562.30. Despite the weakening flat price there remained a firmness for Aug/Jul’24 which widened out a touch further to $143.00, some $10 above Mondays lows. UAg’24 settled at $563.70 to cap off a disappointing week, and downside support will remain in focus when trading resumes on Monday.